This post originally appeared on Substack as a part of my newsletter, East Meets West. Please follow that link to subscribe.

While researching an earlier post on Tencent Music, I kept coming across their competitor, ‘NetEase Cloud Music’. I had heard of NetEase in the context of China’s big internet companies, but I had no clue what the company did.

Below is my brief exploration of NetEase.

Before Ma Huateng (Pony Ma) and Jack Ma, there was Ding Lei. By 2003, at 32 years old, he was China’s first internet billionaire and (for a time) the richest man in China.

Ding founded NetEase in 1997 after a few stints in engineering roles in China’s telecom industry. At the founding, the idea was to “develop large-scale distributed software systems for use on the Internet in China” ❓.

One of the first products NetEase built that struck with consumers was their free email service, ‘@163.com’, a brand that is still synonymous with NetEase today as one of China’s top email clients.

Less than three years later – with US$2 million in prior year revenue mostly from advertising – the company went public on the Nasdaq as the dotcom bubble was bursting. NetEase raised $70mm in late June 2000.

NetEase was not without controversy with trading was suspended in Q3 of 2001 through January of 2002 because of an accounting scandal (recognized revenue in the wrong quarter).

Time has been good to NetEase though, and today, Ding’s US$60 billion empire includes video games, online education, pig farming, e-commerce, online education, music streaming, live streaming, news, and email hosting.

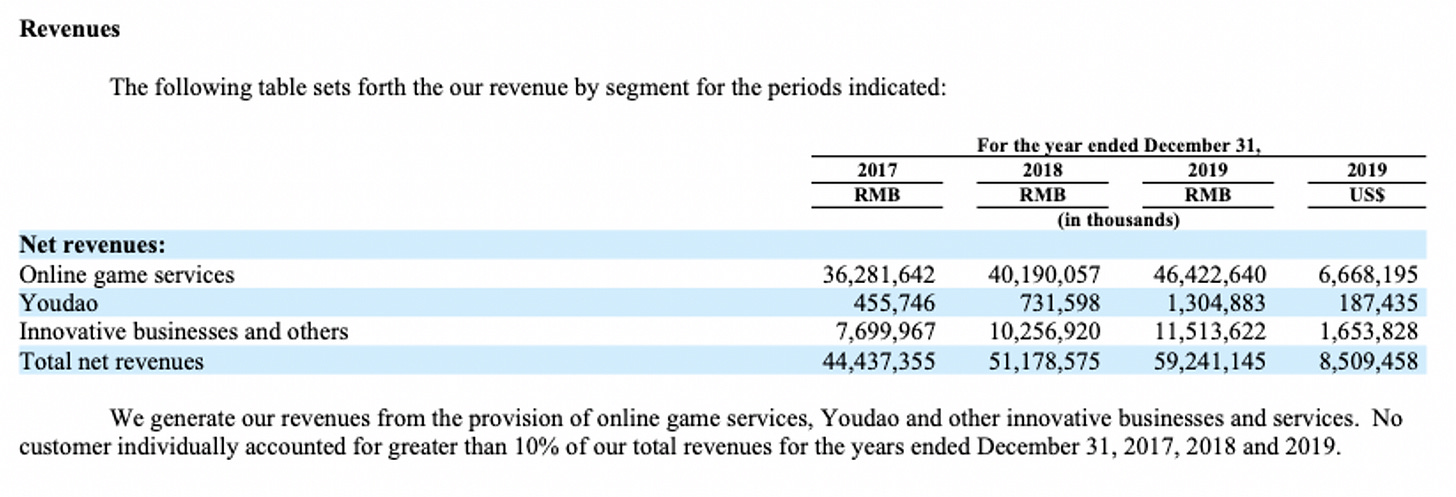

Most of the company’s US$8.5 billion of revenue comes from gaming.

Following the IPO, Ding decided to move the company into developing games. After acquiring a China-based game software developer in 2001, the company began developing massively multiplayer online role-playing games (MMORPGs).

Some of NetEase’s highlighted games

In late 2001, the company released Fantasy Westworld Journey, which over the next few years became the most popular game in China.

Sixteen years later and more popular than ever, in 2017, following iOS and Android releases, Fantasy Westworld Journey did $1.5 billion in revenues worldwide. It was the second-highest-grossing game of the year, behind only Arena of Valor (not surprisingly, a Tencent game)

Simplistically, the past 20 years for NetEase could be summed up as

(Naturally, easier said than done)

At a glance, NetEase in 2020 looks like a smaller Tencent.

NetEase’s revenues are heavily reliant on gaming:

Tencent, on the other hand, is more diversified with only about ~30% of its total revenues coming from gaming.

In gaming, NetEase pursues a strategy similar to Tencent that I covered in my Tencent Music issue,

“The road of foreign companies trying to enter China is littered with dead bodies. Having seen the failure of Google and Facebook to meaningfully enter China and the mixed results of younger companies like Uber, foreign companies realize that entering China directly is a battle that might not be worth fighting.”

NetEase, like Tencent, is great at partnering with non-Chinese companies and being a partner (through a JV or similar structure) to the many businesses that wish to access the Chinese market.

Source: South Park, Comedy Central

About 8% of NetEase’s annual revenues between 2017 – 2019 came from games licensed from third-party developers.

Harkening back to the South Park photo above (that episode got the show banned from China), NetEase is also partnered with Marvel to develop games, television shows, and comics with Marvel characters for the Chinese audience.

One of the first initiatives was Marvel Super War, a League of Legends-esque game using Marvel characters that was released in South Korea, Japan, Southeast Asia, India, and Australia.

Beyond that, Marvel and NetEase worked together to create Marvel’s first Chinese superheroes. The characters were created by Chinese artists and writers, reviewed and approved by Marvel, and then introduced via a comic:

Some other NetEase partnerships that bring foreign IP into China include:

While NetEase does have some very high-profile JVs, most of the company’s revenues are still derived from its portfolio of about 150 in-house developed games. Mobile games are especially important for NetEase accounting for 71% of gaming revenues.

Writing this NetEase breakdown helps me to understand the value of intellectual property and the value of ‘cinematic universes’ in a much deeper way.

Besides licensing other company’s IP in China, NetEase has a plethora of in-house IP from its hundreds of mobile and PC based games. It’s begun to go past gaming, developing one of its hit games, Onmyoji into a feature film.

NetEase also takes advantage of some “IP arbitrage” (perhaps, regulatory capture would be more accurate) where it can find popular global IP (e.g., Marvel Universe) and then work with Marvel to bring that content into China.

The regulators have made this practice even more pronounced in gaming where recent regulations have mandated that “Foreign game companies must work with a domestic game publisher who will operate the game in China.”

The other IP arbitrage that someone like NetEase can capitalize on is taking a popular gameplay mechanism (i.e., League of Legends’ MOBA style of play) and creating a clone using Marvel IP. Marvel Super War, highlighted above, seems to follow that exact strategy.

In terms of building lucrative in-house IP, I glossed over the fact earlier that NetEase first released Fantasy Westworld Journey in 2001, and then in 2017 (16 years later) when the mobile versions of the game were released, NetEase was still able to generate US$1.5 billion in annual revenue.

As a Niko Partners report highlights:

Legacy titles get expansion packs and new content regularly to keep players engaged. Fantasy Westward Journey has become an evergreen IP for the company and its revenue grew at a double-digit rate in 2019, despite being 15 years old and an MMORPG –a genre that has lost momentum overall. More recently they have adapted the hit PC games for mobile, extending the lifecycle of the IP and increasing overall engagement and spend by reaching the much larger mobile gaming audience.

The Fantasy Westward Journey IP has grown significantly since its mobile game release in 2015 and is set to grow further this year with a new title in the franchise, Fantasy Westward Journey 3D, which provides a new graphical style and additional gameplay features.

NetEase also has a history of selling off or IPO’ing its new bets. This strategy seems uncommon of the current crop of American tech companies. The only modern western example I can think of quickly that does this are the companies within Barry Diller’s IAC empire.

Some examples from NetEase include:

Among the ‘other bets’ (or as NetEase calls them, “Innovative businesses and others”) that remain in-house, NetEase’s properties include:

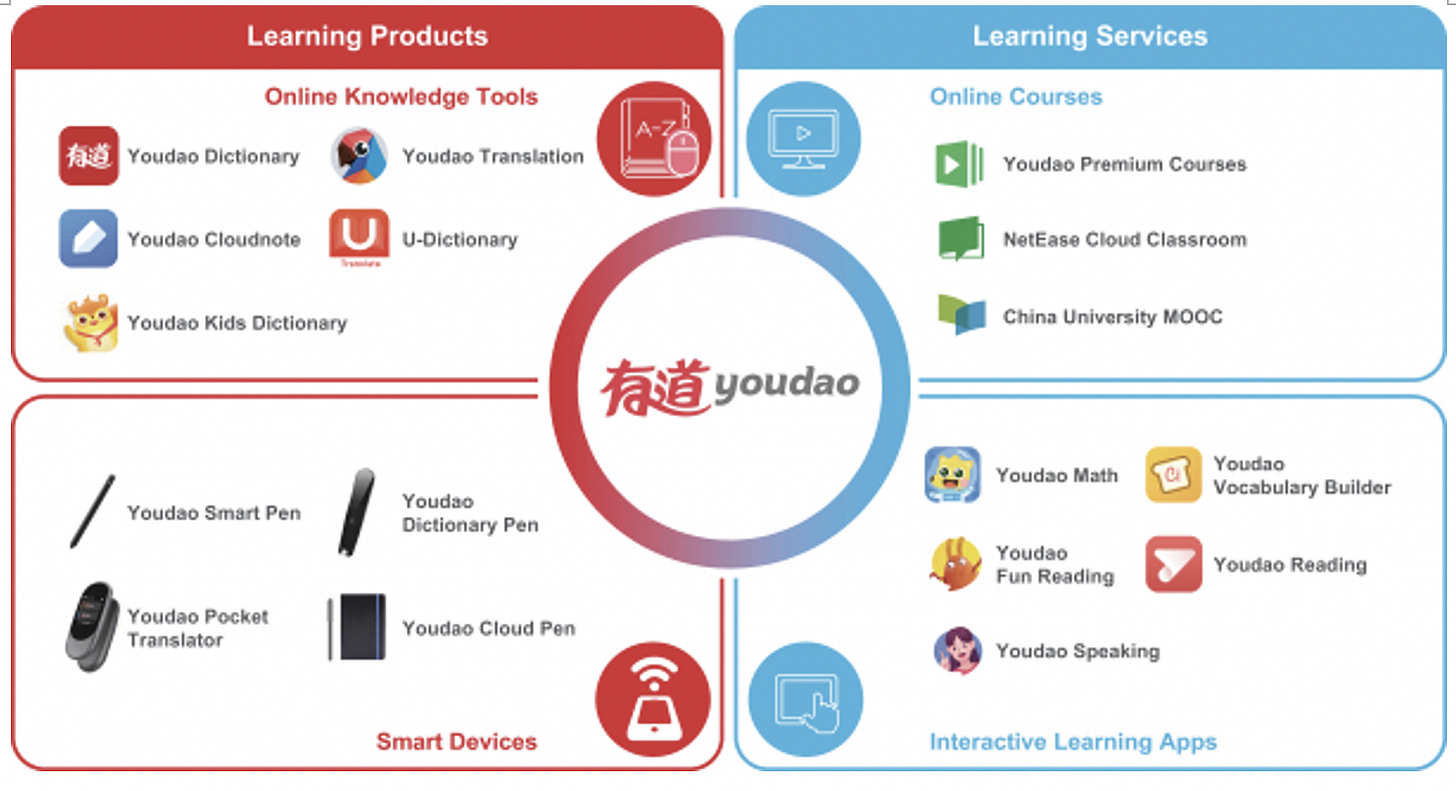

One of the big bets NetEase has made and that is broken out on its financials is Youdao which, at the highest level is a tech-enabled learning company. It has a wide suite of learning products and services.

Revenue comes from:

One thing that is immaterial to NetEase’s business, but that I felt the need to cover are Ding Lei’s pig farms, NetEase Weiyang.

China is the world’s largest supplier, producer, consumer, and importer of pork.

Since 2011, NetEase has been building pig farms throughout China. As recounted on one website:

The story began when Ding Lei, the company’s founder, was eating hotpot with friends and began to worry that the blood tofu, a traditional ingredient made of coagulated pigs’ blood, was synthetic. At that moment, Ding’s business plans turned from gaming into pig farming.

Today the company operates four major farms. In 2019, NetEase agreed to invest US$211 million to build the fourth pig farm outside of Shanghai.

Industrialized farming is an information business, and Weiyang declares itself to be combining “internet thinking and modern agriculture”. That means farming with the kind of detail and precision involved in developing software – a level of control over every microscopic variable along the way, such as pig stress levels.

While Ding does not intend to make a ton of money with his pig farming operations, his goals are to, “revive Chinese livestock-rearing methods and to win government and consumer goodwill for NetEase.”

Or as he said on a separate occasion:

When describing his vision for Netease pig raising, Ding Lei used an analogy - he hopes to put the open-source Linux thinking in the computer field on pigs. “Linux is open and free. We use the Internet to disclose the entire process and data of pig raising. Let’s participate together, share it together, improve it together, and make the production model more efficient.”

This is something that other major companies in China have taken notice of:

Long, pork! 🐷

All said, China’s regulation of the gaming industry creates positives and negatives for NetEase

Headwinds for NetEase, as Niko Partners points out, include:

But the flip side, as pointed out above, is that foreign companies looking to have their game in China will need to work with a domestic partner.

If NetEase continues its growth throughout SEA and Japan tied with a more monopolistic position as one of the few Chinese partners for international companies looking to expand, Netease has an exciting few years ahead.

(Sorry for a lame conclusion this week! I was a bit stuck on how to best wrap this one up😅😅)

First published on December 6, 2020