When thinking about the rise of autonomous vehicles (”AV”) in the United States, there are several speed bumps that need to be addressed. I believe most concerns fall into three main buckets:

**Consumer Adoption**

In a room of Silicon Valley technology entrepreneurs, the overriding sentiment was 10/10 that we are going to see autonomous vehicles on the road, in significant quantities, in our lifetime, but there were a lot of clarifying questions around what exactly that looks like. Within the consumer space, how we make this move depends on a handful of factors with one of the most prevalent being what automobile ownership looks like moving forward. It has been hypothesized that many people living in cities are already passing on car ownership due to factors such as increasing traffic times and high parking costs. These non-car owners utilize public transportation, walking, and Transport Network Companies (”TNC”— Companies like Lyft and Uber). For many people, the decision not to own a car makes a lot of sense, as Dan Neil of the Wall Street Journal points out below:

The absurdity of our century-old, ad hoc approach to mobility is captured in one statistic: The utilization rate of automobiles in the U.S. is about 5%. For the remaining 95% of the time (23 hours), our cars just sit there, a slow, awful cash burn, like condos at the beach.

With cars sitting idly for nearly the entire day (traffic spikes occurring during morning and late afternoon commute times on weekdays), it makes sense that Americans would choose to pass on ownership and all the costs associated with it (insurance, maintenance, gas) in exchange for less expensive (public transport), less committal (TNCs), and free (walking) forms of transportation.

However, contrary to observations of many in urban environments, IHS Markit reports that as of January 1, 2016:

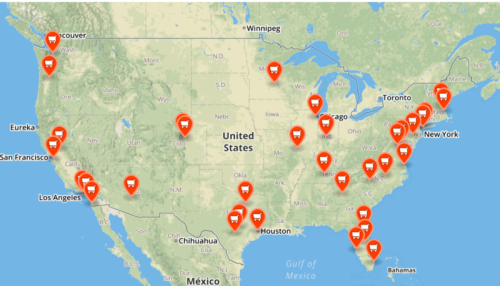

It largely appears ride-sharing services are growing complementary to car ownership rather than as an outright replacement. Outside of urban areas where the supermarket is in walking distance, delivery services like Instacart are common practice (see the map of Instacart markets below), or there are established and dependable public transportation systems, car ownership is still a necessity.

Source: Instacart Service Areas. I use an Instacart as an example here for a greater trend. Most of the tech-enabled services that are common to the readers of this article are concentrated in urban hubs. There is a good chunk of the country that has never heard of Instacart (and similar services for laundry, house cleaning, dog walking, etc.)

In regards to car ownership, I concede that it difficult to break down. In my research, a lot of the studies I come across that specifically analyze trends in urban areas are from 2013 or earlier (and in my opinion don’t capture the impact of TNCs that really took off in 2014-2015). If any readers have research they could share regarding urban v. suburban v. rural car ownership trends, that would be appreciated. Overall, my opinion is that in urban areas and areas just outside of urban areas, it is logical to see a decrease in car ownership, while in suburban and rural areas, a lot more needs to happen besides just TNCs to have an impact on car ownership.

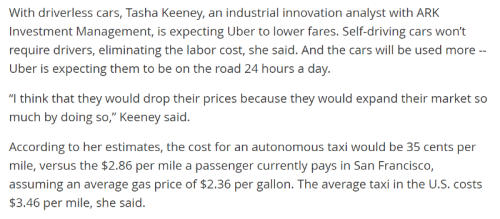

There is a hypothetical situation where I can see the ownership trend being reversed, but it involves at least two difficult factors (miracles) to line up. For me, the thought of a $5 Lyft to Safeway and a $5 Lyft home from Safeway seems like an avoidable double-digit added tax on top of my grocery bill. However, if that ride was only $1 — $3 each way, I would be more open-minded. That’s where autonomous vehicles come in. As Industrial Innovation Analyst, Tasha Keeney of Ark Investment Management states:

Source: Driverless cars could cost 35 cents per mile for the Uber consumer

The first assumption here is that we get to a point where regulators allow TNCs to have fleets of AVs on the road or that enough people own autonomous vehicles and loan them out to provide rides when they are not in use (it would have to be a critical mass to drive down ride prices). The second assumption that I believe is critical to the first assumption is that TNCs own their own fleets of autonomous vehicles. The cost to have a fleet of AVs capable of meeting the demand for an entire city would be astronomical.

On the average weekday, San Francisco gains about 160,000 more bodies in the form of workers who commute in from various Bay Area counties

Estimates from the San Francisco Examiner, in conjunction with the San Francisco Treasurer’s Office, say that as of November 2016, as many as 45,000Uber and Lyft drivers are operating in San Francisco. 160,000–45,000 = BIG GAP.

TNCs would need to make a fundamental business model shift from transportation network companies to fleet providers for this to become a reality. It should not be understated how big of a shift this would be. While no TNC company slide decks are leaked online, one can imagine what a key investment point into a company like Uber or Lyft is… capital efficiency! I will not attempt the math here (maybe a project for another time), but if there are currently 45,000 Uber and Lyft drivers in SF, let’s assume (naively) 50/50 for each company and that at bare minimum an AV would be $20K (again a naïve estimate), that means each company would have to shell out $450 M just to get an AV market built out in SF. This estimate doesn’t even include other ancillary costs of car ownership like insurance, parking, gas (people often interpret the rise in AVs as a simultaneous rise in electric and battery-powered vehicles, but that isn’t true in a 1:1 sense)

Okay. So, there’s a lot of difficulties surrounding bringing TNCs to market as the leading form of autonomous transportation. For non-autonomous cars to lead the way in the transportation-as-a-service (”TAAS”) market, a lot of people still need to own cars to be able to provide service to those that don’t. In the autonomous realm, TNCs need to be willing to make HUGE capital investments to bring large autonomous fleets to consumers. Then there’s a third scenario (not yet explored) in which a % of consumers own AVs and have them drive people around (TAAS-style) during the 95% of the day when they’d otherwise be sitting idly. Elon Musk has spoken the most about this and it sounds like a huge incentive to own a Tesla. If your Tesla earned you $50/day chauffeuring others around for the 23 hours you aren’t using it, you could pay the car off in 2 years flat (assuming you drove a no-frills Tesla Model 3). Obviously, there are some factors in there that still need to be worked out, but in theory, it is kind of the perfect hybrid model between pure TNC market domination, car ownership, and the rise of AVs. For similar reasons mentioned above when discussing how difficult it would be for TNCs to transition to fleet owners, a lot of current automobile OEMs are extremely well-positioned to take advantage of this possible shift. Example: If Toyota could retrofit the Prius to be autonomous and then set up a TAAS network (maybe in partnership with other OEMs), they could take advantage of their production facilities and all the cars they already own to beat TNCs to the market.

**Government Regulation**

In a lot of ways, the media has painted a classic, “Us vs. Them”, “Government vs. Innovation” story surrounding the development of autonomous vehicles. In my research, this seems to be an inaccurate description of the actual actions taken by the government. While the Uber story of December 2016 where the California DMV revoked registration for self-driving cars due to lack of permits got a lot of attention, it is contrary to the experience other groups have gotten while working with government officials.

We envision in the future, you can take your hands off the wheel, and your commute becomes restful or productive instead of frustrating and exhausting, said Jeffrey Zients, director of the National Economic Council, adding that highly automated vehicles “will save time, money and lives.” Source

One study from AAA points out another instance in which governments can support the consumer adoption of autonomous vehicles:

Half (54%) of U.S. drivers feel less safe at the prospect of sharing the road with a self-driving vehicle, while one-third (34%) feel it wouldn’t make a differenceand only 10 percent say they would feel safer.

and that

Three-quarters (78%) of Americans are afraid to ride in a self-driving vehicle.

In many ways, support from the government can provide legitimacy to the claims that AV companies are making surrounding improved safety in their vehicles. For that to happen though, developers of autonomous vehicle technology need to be willing to share data with governments.

This support from the government towards companies developing autonomous cars is not to say that government involvement and regulation are not needed for the industry to be successful long-term. Towards the end of his presidency, speaking to a room of technology entrepreneurs, Barack Obama described the difference between running a tech company and running a country:

The final thing I’ll say is that government will never run the way Silicon Valley runs because, by definition, democracy is messy. This is a big, diverse country with a lot of interests and a lot of disparate points of view. And part of government’s job, by the way, is dealing with problems that nobody else wants to deal with. […]

Like with most disruptive technologies, there are those who lose amidst the change and find themselves in a worse position. While it’s easy for groups like Lyft or Uber to continuously think about the longevity of their products and the positive effects that will come from increased adoption and use, it is less plausible that these companies will dedicate time towards highlighting the potential negative consequences that someone less bullish on the product would consider. Without government regulation in place to tax TNC rides, it is not unreasonable to assume a couple things:

The net effect of these hypothetical scenarios is highlighted in a recent study out of NYC showing that with the rise of TNCs, there are more cars on the road. Some highlights from the February 2017 report, “Unsustainable? The Growth of App-Based Ride Services and Traffic, Travel and the Future of New York City”:

I encourage everyone reading this to read the entire report as it covers a lot more than my select highlights above. However, the 5 points above summarize the message that I am trying to convey here and are a demonstration of some of the reasons government regulation is needed. In the summer of 2015, Uber announced:

With UberPOOL, our goal is simple: take 1 million cars off the road in New York City and help eliminate our city’s congestion problem for good. We want to do our part and invest in creating a less congested, greener future for New York City.

1.5 years later, the aforementioned NYC report has shown the exact opposite. Bullets 1–4 above demonstrate that more rides are being taken, people are switching from public transport and walking/biking to TNCs, and TNC usage is outpacing public transportation growth. Bullet 5 speaks directly to the second point that I make above. There are peak hours where the number of TNCs on the road can’t meet the number of requests coming in. Surge charges aside, what this also means is that people who used to walk and use public transport are now using TNCs and in turn, there is more traffic during hours that were already the most crowded no the roads (morning commute, evening commute, and weekend bar hours)

**Technology Overlap**

*Disclaimer: I am not a technical expert on AVs so if something is blatantly wrong here, please flag it to me*

“There is a presumption that autonomous vehicles will decrease the number of accidents on the road, is that true?” To many this claim raises eyebrows.

There are a lot of moving parts when it comes to safe and successful implementation of AVs on the road. As I alluded to in my opening, it is easy to imagine two Tesla Model 3s communicating with each other, but it’s a lot tougher to imagine a Tesla Model 3 communicating with a drunk driver. It’s getting a lot of buzz, but as I am writing this article, (and just down the street from me at ASU) an Uber self-driving car was t-boned by a manually operated vehicle that failed to yield. “Police were called to a crash at approximately 6:25 p.m. Friday [March 24, 2017] to find that the Uber SUV had been hit when another vehicle failed to yield, according to the Tempe Police Department. No serious injuries were reported.”

Source: Twitter (You can see the LIDAR on top of the Volvo)

From what I can see, there is no fault to Uber in this incident, but in an indirect way it contributes to the point I am trying to make here: while AVs may objectively be safer than human drivers on a test track or in an AV-only world, how much safer are they in a world of human drivers and AVs?

The other issue that makes AV implementation difficult at scale is that in the current ecosystem, there is limited communication between developers of the technology. This leads to a lack of industry standards and does not create a clear path for inter-company vehicle communication. Again, this is a role that the government may need to fill. As much as it will come off as slowing innovation, governments may need to come in and set standards for vehicle-to-vehicle communication and another AV regulations to ensure the safest experience for pedestrians and others on the road.

Prior to typing this post, I was very bullish on the speed at which autonomous vehicles would be on road, in bulk. Now, I am a bit more skeptical of the speed at which we will see AVs as the norm.

First published on October 22, 2017