This post originally appeared on Substack as a part of my newsletter, East Meets West.

Coupang’s S1 presents a compelling and succinct mission:

To create a world where customers wonder ‘How did I ever live without Coupang?’

This one will live in my ‘memorable mission bank’ along with other companies whose missions’ you can probably recall without searching (Google, Stripe, SpaceX, Amazon)

Coupang is Korea’s first real blockbuster startup, 2021’s largest US IPO so far, and is now valued publicly at ~$80bn, having peaked at ~US$100bn on its first day of trading.

Reminiscent of Amazon’s core business, Coupang is a complex logistics organization that makes its money through e-commerce and on-demand delivery. Coupang is probably what Amazon would have been if it were founded during the mobile era. To use western analogs, Coupang’s is a combination of Amazon (e-commerce, proprietary logistics) + DoorDash (food and on-demand delivery) + Instacart (groceries).

Coupang was founded in 2010 by Bom Kim after dropping out of HBS in the same year.

Kim’s story reminds me of Gojek’s Nadiem Makarim (HBS ’11) and Grab’s Anthony Tan (HBS ’11) who had similar stories of being at HBS, seeing the innovation American companies like Uber, DoorDash, Amazon, etc., and deciding to bring that back to their respective home countries.

Like many other Asian entrepreneurs around the 2010 time period, Bom Kim also drew a lot of inspiration from Groupon. As Forbes recounts:

“Kim headed off to Harvard Business School, where he grew fascinated with Groupon and flash sales sites like Gilt Groupe–and was convinced he could transplant the idea to Korea. He raised $2 million from American investors, including hedge fund billionaire Bill Ackman, and dropped out of school in 2010.”

(🐐🐐🐐🐐🐐🐐)

Very quickly though, in addition to selling other people’s deals, Coupang also started selling its own merchandise, starting with travel packages and fresh foods.

By 2015, the company had raised about US$400mm, crossed US$1bn in sales, and was preparing to go public with its Groupon/eBay-esque business when Bom Kim scrapped plans for an IPO in order to turn Coupang into what it is today, an end-to-end e-commerce and logistics company. Goodwater Capital sums this up in their write-up:

When it started ten years ago, Coupang started with a seller-centric interface similar to eBay, but moved over to a product-centric interface more akin to Amazon in order to solve problems like duplicate listings and multiple prices in order to make the customer experience better.

It’s at this point that people (investors, the media, consumers) began drawing comparisons to Amazon. Coupang embarked on building their own logistics network, called Rocket Delivery so that they could “delight customers” by owning the experience end-to-end and guaranteeing delivery times. Kim recounted this period and shift by saying:

“What seemed like a curse at that time — that we had to build this entire infrastructure, and build the technology to integrate it all, end-to-end, by ourselves, from scratch — ended up becoming a huge blessing,”

Rocket Delivery is one of the core differentiators of Coupang that has allowed them to surpass the competition. Coupang’s CEO has referred to the Rocket Deliverymen as ‘the weapon that Amazon doesn’t have’. In the early days, “to win over female customers in their 20s and 30s — a key demographic — Coupang Men handed out flowers and handwritten cards, snapped photos of packages to confirm delivery, and would know not to ring the doorbell at homes with babies.”

Today, several of the company’s executives (CFO, previous COO) and key employees (head of private label, head of fulfillment services) hail from Amazon. Coupang also operates Korea’s largest directly employed delivery fleet in Korea with 15,000+ drivers

One of the reasons Coupang is able to offer its customers such crazy delivery speeds is that, in addition to building up a vast logistics network,

“70% of the population lives within 7 miles of a Coupang logistics center. Our operational infrastructure spans over 25 million square feet across over 30 cities, a footprint of over 400 football fields in a country that is 1% the size of the US geographically. Coupang has the largest B2C logistics footprint as compared to other product e-commerce players in Korea”

As Goodwater highlights, “So while South Korea has the same amount of land as Indiana, its actual usable land area is actually closer to that of Rhode Island.”

While on the surface, Korea is a small country (population of 50mm), the opportunity reminds me of a question I received from a reader a while back.

A subscriber asked,

“what is the scale of the market that makes sense as a precondition to build a SuperApp or at least worthwhile in the direction of SuperApp? US, China and Southeast Asia are large markets. What about Israel, Italy or Korea? Are these markets big enough to sustain SuperApp to make the investment in building one worthwhile?”

I responded:

I’d say it has less to do with the overall scale of the market, but rather with the sophistication of the country’s internet economy. I talk about this a bit in how to build a super app with a focus on the fact that there are already a ton of great apps in a developed internet economy (e.g., US) and it would be tough to get all of them to rebuild mini-programs and interoperability on top of another app. Netflix is not longing for Uber’s distribution and vice versa.

A follow-up thought that I briefly mentioned in the WhatsApp piece is that right now WhatsApp is doubling down on countries with the most internet users (Brazil and India), not countries with the highest GDP (Japan, Germany, UK)

By that framework… Nigeria w/ 123M internet users and GDP 400bn is more primed for a Super App than Italy with 54M internet users and 2 trillion GDP.

At the time Sequoia led Coupang’s 100m funding in 2014 (of course they did), Michael Moritz said, ‘Coupang is “the leading online retailer in South Korea – one of the most attractive e-commerce markets in the world.”’

I was surprised to learn that Korea has the highest smartphone penetration of ANY country in the world (Korea: 96%, USA: 89%, China: 71%)

Bom Kim knew this and from the beginning, Coupang has been a mobile-first commerce company with 70% of its transactions happening on mobile, as far back as 2014, Kim remarked “All of this makes us, we think, a glimpse into the future of e-commerce for the rest of the world”

Beyond that,

“South Korea’s e-commerce market is projected to be the third-largest in the world in 2021, according to Euromonitor, behind only China and the U.S. The business is large compared with the size of the economy because of a blend of speedy service, dense populations, fast internet connections and fierce competition among family-run conglomerates, such as Shinsegae Inc. and Lotte Shopping Co.”

While Coupang isn’t a Super App in the way we’ve described other apps in this newsletter (no mini-programs, native payments are still very nascent), it does seem primed to make that evolution if it chooses to.

Most notably, Coupang is missing a prevalent payment system for its home country. It does operate a ‘one-tap’ pay product, but that is more along the lines of what you’d find in Amazon’s app (i.e., can be used within its closed ecosystem) and not a generalized payments product like AliPay, WeChat Pay, Grab Pay, etc. that can be used at merchants all over the home country. I don’t know enough about Korea to write intelligently about whether or not the market is primed for Coupang to offer that service, but it does not seem as if any other digital player has won that market.

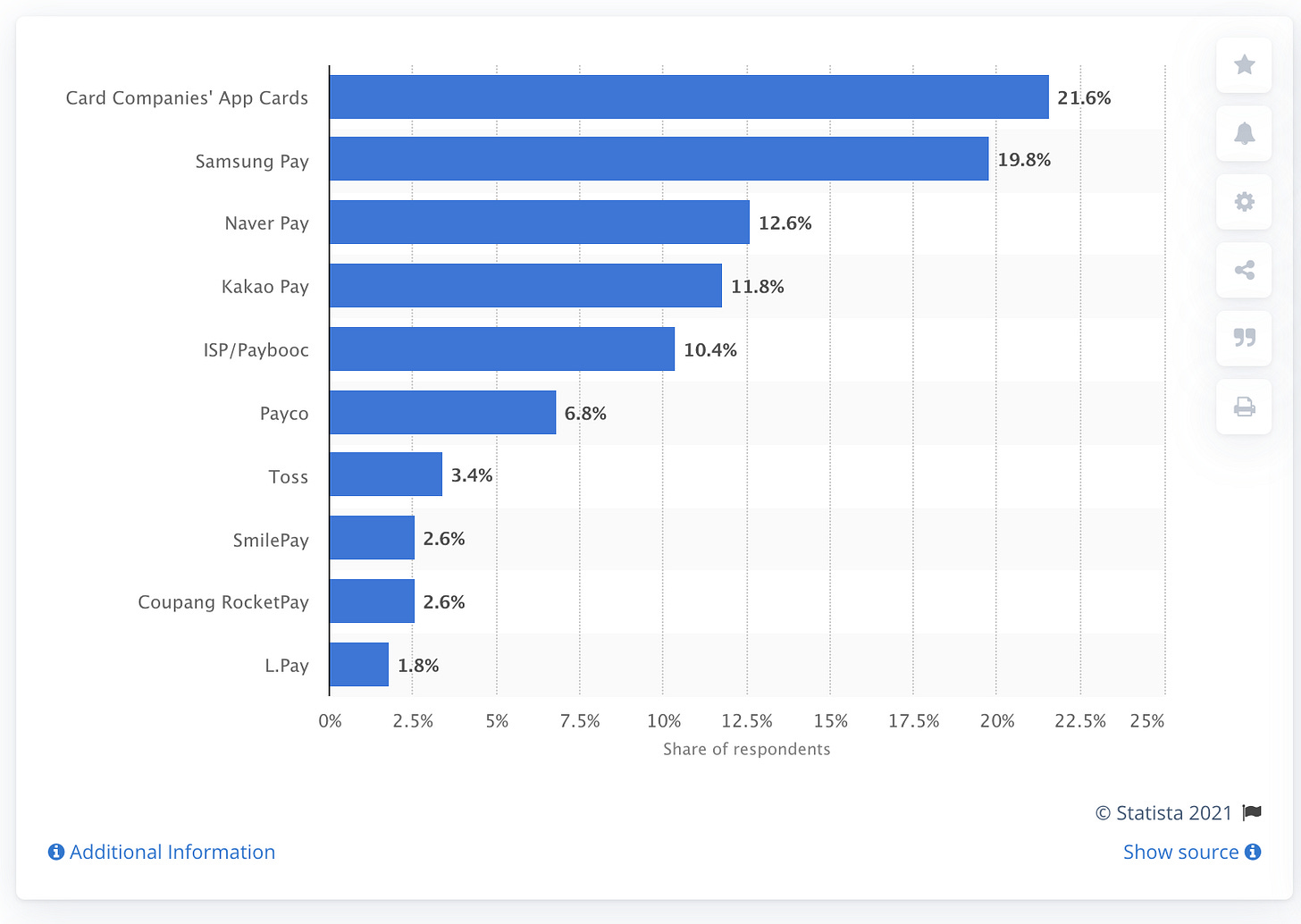

Source: Statistia

Data from Statista shows,

According to a survey in South Korea in 2019, “app cards” mobile payment method provided by card companies directly through their mobile apps were the most used form of mobile payment. The number of people who have used mobile payment methods has increased over the past few years, however, app cards have seen steadily decreased usage while Samsung Pay has seen modest increases as the most commonly used method.

As we’ve described Super Apps in the past in this newsletter, Kakao and Naver seem to be the only companies that meet that bar, but it’s not a clear-cut winner in the same ways we’ve discussed other apps. We should not rule out Coupang’s ability to become a Super App, but it is not a clearly stated goal for the company.

Masa got a nice section in my piece on Ant Group and he is worth highlighting again today.

Since DoorDash’s IPO I’ve been thinking that the Softbank Vision Fund probably doesn’t deserve all the sh*t that has been throw at it.

Softbank invested about US$3bn in Coupang over the years for a stake that is now about 35% of the company.

0.35 * 100bn = 🤯

CEO Magazine points out that “Coupang was the biggest US initial public offering (IPO) by a foreign issuer since Alibaba Group Holding in 2014, and the biggest US new issue of any kind since Uber Technologies in 2019.“

Let’s not forget DoorDash, Grab, Didi, and many others.

In speaking to Barron’s, Lydia Jett (Softbank’s rep on the Coupang board) said:

SoftBank did not sell any shares in the offering, and Jett says in an interview with Barron’s that the company intends to be a long-term investor, as it has been with Alibaba. More than 20 years after its initial investment, SoftBank’s remains the single largest holder in Alibaba.

💎🤚🏻💎

The #1 reason I wanted to write about Asian tech companies was I believed it would be helpful for people in the west to understand the business models of Asian technology companies. I think my issue on Tencent Music was the best version of this.

From the East Meets West about page:

In Zero to One, Peter Thiel said, “The easiest way for China to grow is to relentlessly copy what has already worked in the West.”

At some point, that was true.

However, I don’t think it’s true anymore. Already, Western technology companies, especially consumer-focused companies, are looking to China and SEA to copy ideas coming from Asia’s best entrepreneurs.

More often, we will see western technology companies “relentlessly copy what has already worked in the [East]”

I think right now, we’re in the tail-end of Asian consumer-focused companies (enterprise software is a different story) looking West to replicate the successful models of American tech companies.

Harkening back to Rocket Internet, there is something to be said for companies that successfully recreate western business models in their home countries

In recent YC batches, you see a lot of ‘X for Country’ and even though Rocket Internet was viewed as a copycat in its heyday, there is a lot of validity to this strategy.

There are many reasons to be a long-term optimist on Coupang. As one Seeking Alpha writer highlights:

The digital shopping platform has grown tremendously over the last few years. On a quarterly basis, revenues grew by 400% from the first quarter of 2018 to the fourth quarter of 2020, a rise from $900 million to $3.8 billion. On an annual basis, that represents a revenue compound annual growth rate (CAGR) of 43.46%, with revenue growing from$4 billion in 2018 to $11.97 billion in 2020.

To put that into perspective, only 0.7% of companies across the world delivered a 3-year CAGR of that magnitude, between 1950 and 2015.

COVID has been a massive accelerant for Coupang’s business and there is always a question of how much of the COVID behavior will stick. My inclination is that a lot of it will. While I’ve never used Coupang, my impression is that it offers its users Amazon (or better) levels of service with a speed that would take years and billions of dollars of investment for any competitor to match.

They seem to have also successfully leveraged the logistics infrastructure they built for e-commerce into food delivery and grocery delivery, with both of those newer businesses emerging as the market leaders. Coupang doesn’t break out specific stats for either in their S1 but claims both divisions are the country’s largest grocer and food delivery services.

This is all in a period when the Korean eCommerce market is on an absolute tear. As the Financial Times reports:

South Korea’s e-commerce market has grown 22% to $71.7bn in 2018, accounting for 24 per cent of retailing, the highest in the world, followed by 23.7 per cent in China, 8.6 per cent in Japan and 13.7 per cent in the US, according to Euromonitor International. South Korea is the world’s fifth-largest ecommerce market and is forecast to become the third-largest after China and the US within five years.

I look forward to following Coupang for the years to come!

As always, thanks for reading!

First published on March 23, 2021