I compare the feeling of waiting for an economic bubble to burst to being on a long plane ride without any idea what time it is. A non-stop flight from SFO to China is 13 hours and if you read for a while, doze off, and don’t look at the clock, it would be very easy to think you are much closer to or farther from your destination than you actually are. That’s how I feel about the current cryptocurrency space. Except in crypto, I feel like our plane might be flying into an interdimensional vortex, and may never land where we expect it to. Hell, if it does land, it might land on the same island that Oceanic Flight 815 did.

I find it hard to read anything from anyone these days that doesn’t believe we are in some degree of a bubble (whether good because it’s bringing attention to the space or bad because a lot of people are going to get hurt badly if/when it burst). And with that, I agree. We are in the run-up period (potentially in the very early run-up) of a cryptocurrency bubble.

The aspect of the argument that does differ from person to person is when (if ever) exactly the bubble is going to pop. You have some people like Chris Burniske saying that we are only about 15% of the way to the true start of the bubble

And then you have others like Preston Byrne giving the impression that we are much closer to a bursting bubble than many would believe.

To be explicitly clear, I don’t totally agree with either of them.

Per Investopedia:

“**A bubble is an economic cycle characterized by rapid escalation of asset prices** followed by a contraction. It is created by a surge in asset prices unwarranted by the fundamentals of the asset and driven by exuberant market behavior. When no more investors are willing to buy at the elevated price, a massive selloff occurs, causing the bubble to deflate.“

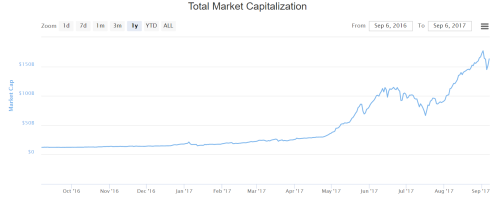

I agree that there has been a rapid escalation of asset prices in the crypto market.

As the two charts below show, the amount of money raised via ICO in 2017 and the increase in the cryptocurrency market cap in the past year has been staggering.

However, I don’t believe this bubble’s contraction will be that large. I especially don’t believe that investors who have been conservative (as conservative as you can be when investing in a volatile asset class, that is) will be hit too badly, if at all. Over the past weekend, we saw a hit to basically every crypto when China unilaterally banned ICOs. However, as many noted on Twitter, it only (temporarily) erased gains from the previous week / month. If you are an investor who heard from your friends how much money they made over the past year in cryptos and then decide to plunge a large % of your personal wealth into cryptos, you are signing on for a lot of risks. If you have been conservatively investing early on in projects over time, you will probably be in a good place (even if this runup deflates).

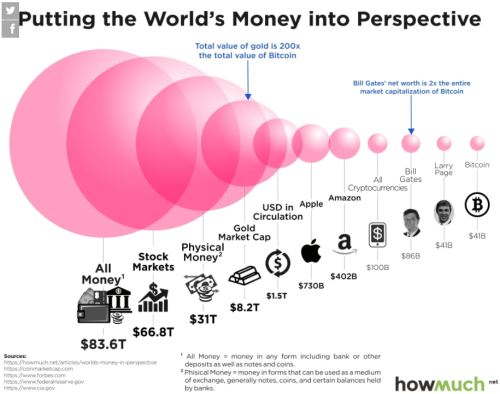

The other argument for why we are either a) not close to the bubble bursting yet or b) the bubble will never burst is because as Ian (and then Ryan and “Moonlaunch James”) said on Twitter, cryptocurrencies still constitute such a small fraction of global “Money” (loosely defined):

Or as this chart points out:

Cryptocurrencies, plain and simple, just aren’t touching as many people as the internet or housing bubble did at their peaks. For all of the hype that cryptocurrencies have received this year, they are still a very fringe investment class, they are small (relative to other investment classes), and they are not “too big to fail” in the way that the banks were in the 2008 financial crisis. If the cryptocurrency market went to ZERO tomorrow with no sign of recovery: I speculate that the people who would be most hurt would be (in this order):

Unlike the housing crisis, the first, second, and third-order effects of cryptocurrencies will not threaten “everyday Americans” in a widespread sense. Don’t get me wrong, if/when this crypto bubble bursts, people are going to lose their shirts. However, it won’t be people we usually feel bad for in an economic downturn.

My other conclusion – which I am still thinking through – is why does this bubble ever have to burst? Of course, projects will fail (and that will be a great thing when the scammy ones do), but the idea that the whole market will fall all at once or that Bitcoin will tank and bring the whole ship down with it seems unlikely. It’s easy to compare the cryptocurrency market to other historical asset crises, but cryptocurrencies are different than any other asset class before them and in turn, might not follow the same overall rise and fall trajectory. Compared to other assets, cryptocurrencies are global, by default, and in turn, have a lot of parties (who would not normally deal with each other) all rooting for the same (or similar) outcomes. The present global success Bitcoin is feeling could be the first successful round of an iterated game between many global parties (Japanese speculators, U.S. investors and academics, and Chinese miners) in which multiple currencies and blockchains will flourish.

Time will tell on this one, but avoiding the markets altogether right now, is a mistake.

First published on September 6, 2017