Ant Group is one of the most valuable companies in the world with an estimated private market value above $250 billion. It is a technology company that offers dozens of financial services products and Super App functionalities throughout China. They also operate globally via joint ventures and investments into other payments companies.

As I write this post, Ant Group is approaching a dual IPO listing in Hong Kong and Shanghai that would see the company raise $35 billion and value it north of $250 billion.

As Bloomberg notes,

If markets are favorable, Ant’s IPO may top Saudi Aramco’s record $29 billion sale.

Ant could exceed Bank of America Corp.’s market capitalization, and be more than twice the size of Citigroup Inc.

Among U.S. banks, only JPMorgan Chase & Co. is bigger at almost $290 billion.

Ant Group’s founder and majority shareholder is Alibaba co-founder, Jack Ma, the Chinese founder most known to a Western audience.

The story of Alibaba is a crazy one, well-covered in a book I enjoyed a few years ago called, Alibaba: The House that Jack Ma Built.

There are several details covered in the book, specific to Alibaba’s funding history that give some additional context to the Ant Group / Ant Financial story.

A brief backstory on Alibaba and its funding history that sets up the Ant Group story:

At their first meeting, after Jack had finished describing Alibaba, by now some 100,000 [users] strong, Son immediately turned the conversation to how much SoftBank could invest

“I listened to Mr. Ma’s speech for five minutes and decided on the spot that I was ready to invest in Alibaba,” Son recalled. Son interrupted Jack’s presentation to tell him he should take SoftBank’s money because he “should spend money more quickly.”

Around the time of Alibaba’s 2014 IPO, Son was asked what it was that prompted him to bet on Jack back in 2000: “It was the look in his eye, it was an ‘animal smell.’ . . . It was the same when we invested in Yahoo . . . when they were still only five to six people. I invested based on my sense of smell.”

(Masa’s sense of smell yielded Softbank about $200,000,000,000 on the Alibaba investment)

Meg Whitman, reflecting on this misstep after she left eBay highlights what is becoming a common theme in this newsletter,

“You’ve got to have a set of products uniquely designed for this market by Chinese. It is not a market where you can take a product or a system that works in Europe or the United States and export to China.”

Localism, FTW!

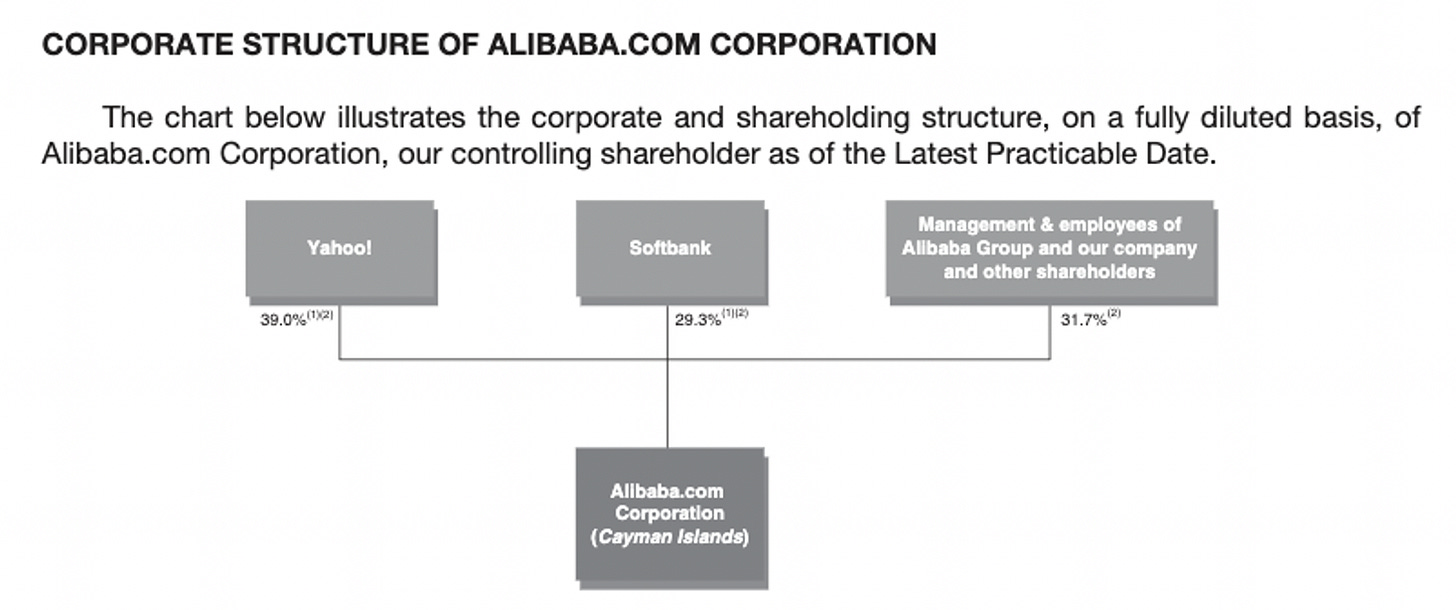

Given all of Alibaba’s fundraising, particularly it’s early stock sale to Goldman Sachs, the share structure of Alibaba, at the time of its IPO was:

Jack Ma owned a much smaller % of his company than many of his peers in the Chinese tech industry. It’s hard to find the exact number, but of that 31.7% owned by management and employees, Jack Ma seems to have owned about 8% total of Alibaba.

After the launch of the escrow service in 2003, the team working on Alipay spent the next several years developing integrations with all the major banks in China. Between 2003 and 2010, Alipay was still predominately just an escrow service, though the importance of this feature should not be undersold. Taobao and Alipay had an extremely synergistic relationship, similar to that of eBay and PayPal. Taobao had so much success in China against eBay because of the trust that the Alipay escrow enabled. As a result, Alipay saw its growth rise in tandem with Taobao’s.

In 2010, the Chinese central bank issued regulations pertaining to third-party payment companies like Alipay. In short, companies like Alipay would need to obtain a license to operate within China and the requirements for foreign-owned companies would be more stringent. Since Alibaba was majority-owned by Yahoo! (US-company) and Softbank (Japanese-company), this posed an issue for Alipay.

In May 2011, it was made public that Alipay, which was estimated to be worth ~$1bn at the time, had been transferred out of Alibaba and was owned by a domestic Chinese company that Jack Ma controlled an 80% interest in. Majority shareholders like Softbank and Yahoo were not informed of the transfer and did not have direct ownership in the new entity. Alibaba also did not maintain an ownership stake in the new Alipay entity.

Per a footnote in Yahoo’s quarterly earnings at the time,

To expedite obtaining an essential regulatory license, the ownership of Alibaba Group’s online payment business, Alipay, was restructured so that a hundred percent of its outstanding shares are held by a Chinese domestic company which is majority owned by Alibaba Group’s chief executive officer. Alibaba Group’s management and its principal shareholders, Yahoo and Softbank Corporation, are engaged in ongoing discussions regarding the terms of the restructuring and the appropriate commercial arrangements related to the online payment business.

This would further sour the already deteriorating relationship between Alibaba and Yahoo, while also putting stress on Alibaba’s relation with Softbank.

The TL/DR of the rest of this story is:

While, to a degree, the split of the two companies makes sense, they are still integral to each other. Alibaba’s CFO was quoted saying, “some 20% of new users to e-commerce platforms Taobao and Tmall came from Ant”.

And while Alibaba is Ant’s largest customer, the % of revenues have been coming down over time. In 2019, Alibaba accounted for 8% of Ant Groups’ revenues and by the first half of 2020, that percent was down to 6%.

This controversy over foreign ownership makes me think of the current TikTok/US Government kerfuffle. But instead of China not wanting foreign ownership of its payment companies (AliPay), it’s the US that does not want Chinese ownership of TikTok.

**Alipay —> Ant Financial —> Ant Group**

Ant Group is a tech-enabled financial services company. It offers a wide range of financial services along with Super App functionality built around China’s top payments platform.

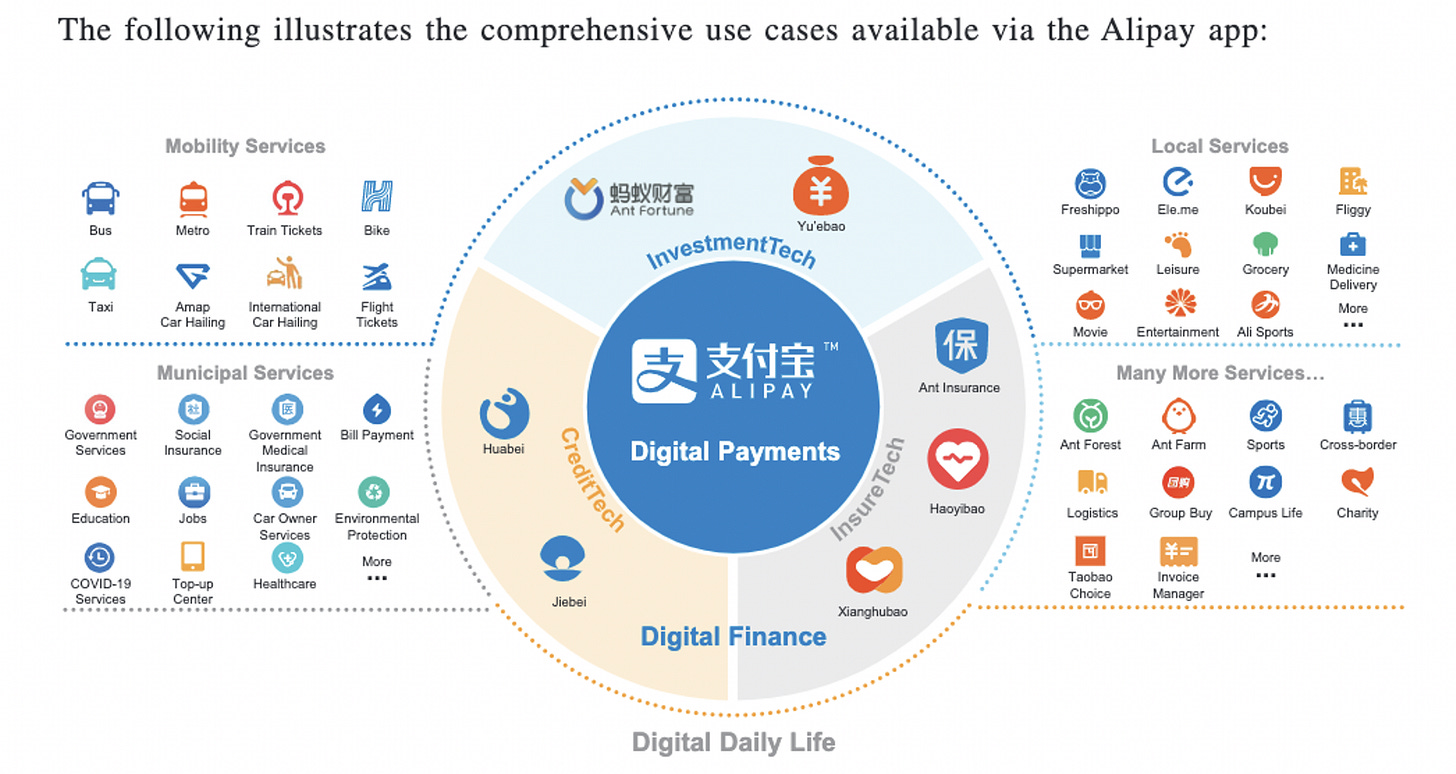

Ant Group describes its business as the “Alipay Platform” which encompasses digital payments, digital finance, and digital daily life services. Today, the Alipay app has 1bn+ users and 80M+ merchants connected to the platform.

The Ant Group S1 breaks its business out relatively straightforward. Payments at the center of everything, surrounded by core “digital finance” offerings including investment tech, credit tech, and insurance tech. Surrounding that inner circle includes all the other apps (mobility, municipal, local, and other) that give Alipay its Super App functionality.

As the company went from being a single product company, Alipay (2003) —> Ant Financial (2014) —> Ant Group (2020), its products and types of offerings grew as well.

By the time of the 2014 rebrand from just Alipay —> Ant Financial, the company’s core properties included Alipay, Yu’ebao and Tianhong (investment platform), MyBank (an online-only lender which Ant owned 30% of), and Sesame Credit (a credit rating system). These were services that were mostly offered directly by the Ant team.

The rebrand from Ant Financial —> Ant Group seems to have been motivated by the fact that the company had become a marketplace of financial products offered by other institutions, rather than just products built by Ant. In some ways, this makes their offerings look more like a technology company monetizing through lead gen for financial institutions, along with some of their own products alongside. This decision seems to have been motivated by a regulatory clampdown,

Ant Financial was singled out by the People’s Bank of China as the only online finance firm for a trial program to test stricter regulations on financial holding conglomerates, two of the sources said. “As a non-bank, non-state-owned institution in China, it’s not allowed to independently grow too big to manage,” said one of the sources.

Earlier on, during the transition from Alipay to Ant Financial, the company ran a playbook similar to what we’ve seen common with other FinTech companies, targeting small businesses and users who were underserved by the traditional banking system and using technology to offer them a wide range of services. As a result, their earliest offerings included digital payments and virtual bank accounts.

Over time, they added other functionality including the ability to pay not just from a pre-funded e-wallet checking account, but also the ability to pay directly from a line of credit or interest-earning money market fund (more on this later).

Beyond that, it is the “digital daily life services” ecosystem built around Alipay payments that gives Alipay its Super App characteristics.

Like other Super Apps we’ve studied in this newsletter, Alipay offers popular applications (ridesharing, home cleaning, pay bills) all within the Alipay home screen. I spoke to some friends in China to get an understanding of where one might use Alipay vs WeChat Pay. WeChat pay seems to be used in low transfer value situations (e.g., send a friend some money) and that its more common to use Super App functionality of WeChat, whereas Alipay is for bigger purchases and other financial focused transactions (wealth management paying bills, etc.).

Overall, Alipay’s Super App functionality seems to be useful.

They state in their S1 that between June 2019 and 2020 that over 60% of users came to the Alipay app for daily life services. I’d personally love to see a breakdown of e.g., Didi rides hailed on Alipay vs WeChat pay.

One of the things I find most powerful about Super Apps we’ve studied is their ability to empower small business owners. Alipay is no exception. They’ve helped to digitize many merchants, giving them new tools to market, create loyalty programs, organize promotions, and interact with users. All built around the experience of payments.

Today, Ant Group generates 99% of its revenue through four business lines that corresponded to RMB 52 billion ($7.6 billion) in revenue for 2019.

QR code payments in China are synonymous with Alipay (and WeChat Pay). Ant Group maintains a duopoly in this market alongside Tencent’s WeChat. In the twelve months preceding June 30, 2020, the total transactions across the Alipay Platform totaled RMB118 Trillion ($17 Trillion, more than China’s 2019 GDP)

In 2010, Alipay launched an updated mobile app that would allow users to make in-person (“online to offline” as they call it) payments using QR codes. This was the catalyst that would transform China into the QR-code payment-enabled country that we read so much about today.

Ant Group also has the coveted position of being the promoted payment option on Alibaba’s massive online properties including Taobao, Tmall, and 1688.com.

Revenue from payments is standard, “charging merchants and transaction platforms transaction fees based on a percentage of transaction volume. We also charge users for personal transactions such as transfer to bank accounts and credit card repayments”. One thing to note is that as a result of charges being applied for transferring back to bank accounts, users opt to just leave balances in Alipay.

Within China, the tailwinds for digital payments are strong. Per iResearch,

“China’s digital payments transaction volume was RMB201 trillion in 2019 […] China’s mobile payments users reached 87.2% of the total mobile Internet population in China in 2019”

Outside of China, the payments business is tougher for Ant Group. They “only” did $91 billion in transaction volume in the 12-months leading up to 2020.

Looking at the rest of Ant’s products, payments were just the opening move. Payments became the way to attract consumers with no marketing spend and to build a giant ecosystem around the app, enabling the rest of the products to grow.

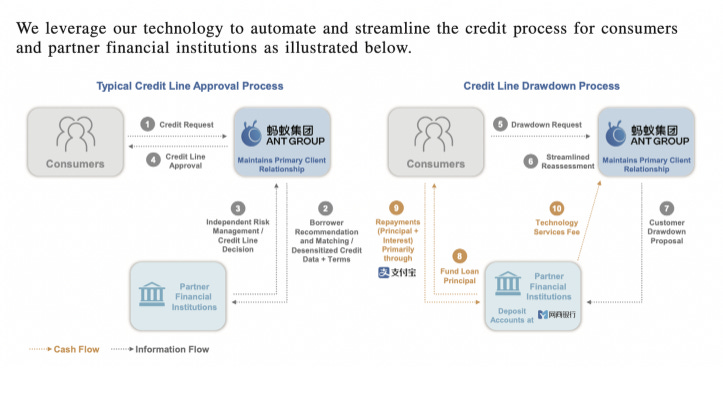

Working with over 100 bank and trust companies, Alipay’s credit offering has a credit balance of RMB1.7 trillion ($255 billion) across its SMB and consumer customers. This makes them the largest credit provider in China for consumers and SMBs. 98% of that credit is underwritten by their financial partners.

Ant Group generates service fees from their partner financial institutions as a percentage of the interest income generated on credit balances enabled through the Alipay platform.

From the S1,

“In credit, we leverage our intelligent decisioning systems to originate loans which are then primarily underwritten by financial institutions. For these financial institutions, our technology and customer insights allow them to cost-effectively grow their loan book, while our dynamic risk management solutions maximize the efficiency and effectiveness of onboarding, underwriting and monitoring. Our approach is not to use our balance sheet or provide guarantees.”

Their credit offering is composed of two core products:

These products have extremely low defaults. Since Alipay is connected to all your financial accounts, it will automatically collect repayments first by checking your Alipay e-wallet balance, then your debit card linked to Alipay, then your Yu’ebao (wealth management) account.

The Ant Group teams works closely with their banking partners to “utilize more advanced joint credit risk models”

An overview of how that process works:

Working with 170+ asset managers, Alipay has an investment AUM from customers of RMB4.1 trillion ($603 billion). This makes them the largest investment platform in China.

In 2013, when the Ant team recognized that the Chinese population was very conservative savers (mostly bank deposits and property) they launched Yu’ebao, a money market and investment platform.

Months after launching Yu’ebao, Ant Group bought a 51% stake in Tianhong Asset Management to integrate the platform with one of its underlying financial partners (the fund that would actually be managing the money and generating a return for users).

Very quickly, Tianhong became the largest mutual fund in China and within a few years, was the largest money market fund globally.

As covered briefly in my WeChat issue:

“Alipay launched the Tianhong Yu’e Bao Money Market Fund (which basically amounted to a high-yield checking account) for users in 2013 and by 2017, it was the largest money market fund in the world, surpassing offerings from JP Morgan, Fidelity, and Vanguard. By March 2019, the Tianhong Yu’e Bao fund (which translates to “leftover treasure”) had about 588 million clients, 1/3 of the Chinese population.”

That’s launching a product at scale.

Two of the key features of Yu’ebao are that (1) it has instant redemptions, meaning that users can either spend their invested funds instantly or redeem their funds in cash the same day (2) you can invest with as little as RMB 1 ($0.15). In that sense, the low threshold for participation offered broad financial inclusion for anyone in China with a smartphone to gain access to an account yielding 3-6% annually.

In line with Ant’s broader philosophy of becoming more of a tech firm and less of a financial services firm, Ant Group launched a second investment product, Dalicai (translates to “broad investment management products”). This is a marketplace of different investment products (besides just Tianhong) from different providers and with different risk profiles.

From the S1,

In investments, we operate the largest investment platform by AUM in China for consumers to shop for investment products, providing unparalleled reach to partner asset managers. This platform substantially lowers the cost of investment product distribution and ensures a superior user experience. Investment managers also value our AI capabilities on the platform, providing intelligent matching of investment products against investor’s risk tolerance, for it is critical to ensure product suitability and sustainable industry growth.

At this point, nothing to be surprised about, but working with ~90 insurance institutions, Alipay is the largest insurance platform in China as well with about RMB 52 billion ($7 billion) in premiums and contributions.

It seems that the reason this vertical is so small (relative to Ant Group’s other revenue centers) is due to the fact that China as a country is very underinsured. Insurance penetration in China is about 1/3 of that of the US.

However, even though the dollar amount might be low, Ant Group says that between June 2019 and June 2020, over 570 million Alipay users “purchased insurance or were insured on our platform, or participated in Xianghubao mutual aid program”

A big part of Ant Group’s growth in its insurance vertical comes from Xianghubao, a standalone insurance product that also acts as a sort of top-of-funnel for the group’s other insurance products. The product is well covered in this SCMP article from my friend, Georgina Lee.

In short, Xianghubao is, what Ant Group calls, a “mutual aid” or “collective claim sharing” product. Anyone under 59 years old can sign up to protect against 100 types of critical illness. It requires no upfront payments or premiums. However, whenever a claim is submitted by someone, all the other users of Xianghubao will pay their approved claims. Per S1:

“If the claim is approved, the participant will receive a one-time payout, the cost of which is shared equally by all other participants. In 2019, the average annual contribution made by each Xianghubao participant to cover claims was RMB29 ($4).”

Given the growing user base, every member should pay no more than 0.1 ($0.015) yuan for every critically ill person, according to Ant. It covers a list of no more than 100 ailments. If a dispute over claims arises, a jury consisting of hundreds of thousands of pre-approved users will vote on whether to pay out compensation.

As of June 30, 2020, the product had more than 100 million active members.

And per the S1, it seems like this inexpensive product has made more Chinese people aware of insurance product offerings and has led them to purchase other more typical insurance products (i.e., those underwritten by an insurance partner).

Ant’s other insurance products look similar to the scenario-based insurance products I’ve written about in Gojek and Grab issues. Ant describes this as

“We have designed our scenario-based insurance products based on the unique characteristics of e-commerce transactions, i.e. low-ticket size with high frequency.”

These low barriers to entry products are in line with what Ant did with their investment products and points to what I view as a broader product philosophy for Ant.

Build a product in-house (for investment: Yu’ebao w/ Tianhong, for insurance: Xianghubao), get the market comfortable with an inexpensive, low-friction product, and then open up to a marketplace of more sophisticated products, partnering with traditional financial institutions.

Pretty brilliant and repeatable playbook for other financial verticals. It also seems to stand in contrast to the western approach of starting off with partners and then building their own products to own the whole vertical stack.

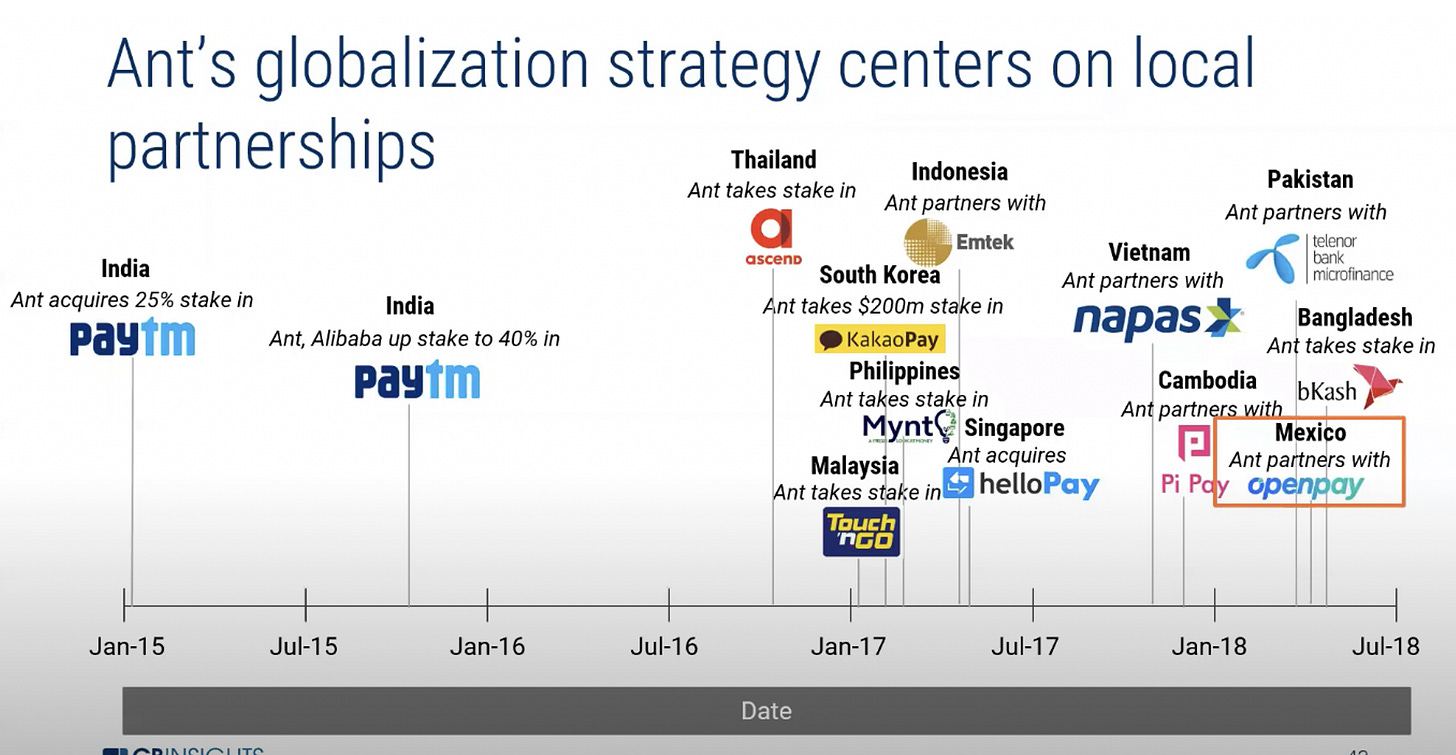

CB Insights points out that Ant has made many investments into international payment companies.

One could imagine the calculus that has made Chinese tech conglomerates (namely Tencent and Alibaba/Ant Group) so dominant as investors is a belief of localization > globalization.

The upbringing of companies like Tencent and Ant Group where the Chinese government clearly favored (and only really allowed) local players to win big markets, likely informed their thinking of how other markets might play out. Alibaba/Ant knew they wouldn’t win India, so they needed to invest in India’s winner. And same for other big Asian, African, and LatAm markets. This is in contrast to the approach of big western companies (i.e., Facebook, Google) where much of their success came from rapid global expansion and as a result, the idea of making big bets on the company that would e.g., win Japan seemed silly since they were ultimately the one who would win Japan.

In that same CB insights presentation, they call out a quote from Alibaba co-founder, Joe Tsai on Ant Group’s broader vision to be a technology partner to many different financial platforms, offering global, interoperable infrastructure.

The case for investing in Ant is strong. It’s a household name throughout China, is growing its higher-margin sectors (e.g., credit) very quickly, and has unique distribution throughout one of the world’s largest markets.

That said, there are a lot of risks present. (1) There has been increasing regulatory scrutiny of Ant, which they are working to minimize, but that is still present. (2) It’s unclear when/if China launched a Central Bank Digital Currency (“CBDC”) aka RMB on blockchain how Alipay will fit into that (3) Tencent / WeChat Pay are a growing risk to Alipay. We’ve covered in the past how WeChat was able to crowd Baidu out of the search market as users turn to WeChat for initial search inquires. It’s not hard to imagine WeChat doing the same to people who currently turn to Alipay for financial offerings.

In the comments, please let me know what you think about this article and Ant Group broadly!!

As always, thanks for reading!!!! 😁

First published on October 4, 2020