This post originally appeared on Substack as a part of my newsletter, East Meets West.

If you’re reading this post, but haven’t read WeChat (Part 1): A Not So Brief History, you should check that out first!

Part One was a deep dive into the history and product of WeChat. This article will focus on the themes of the company and some of the key elements of its monster success.

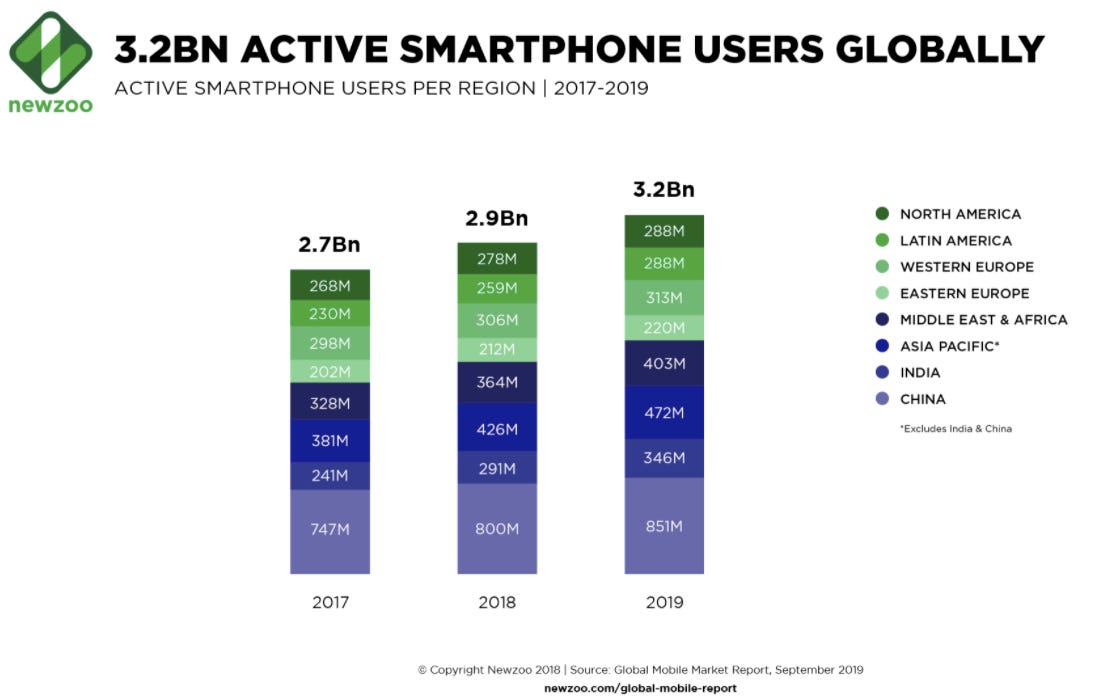

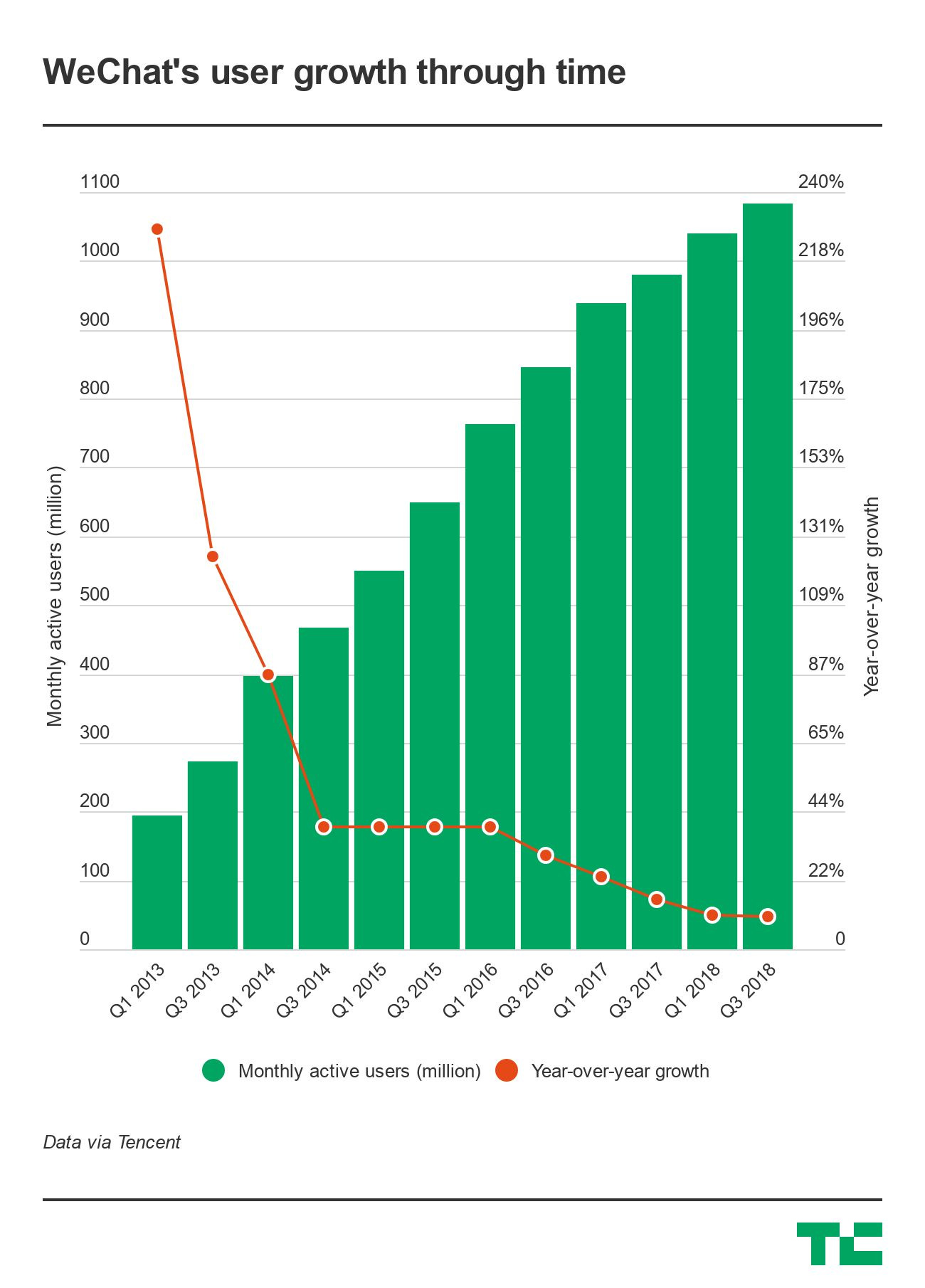

WeChat users grew in tandem with smartphone growth in China.

In 2010, when WeChat was still a research project, there were only 36 million smartphone sales in China. That number increased to 90 million in 2011 when WeChat was officially launched and had rocketed to 214 million by 2012.

As of late 2019, China had 851 million smartphone users, accounting for 26% of the world’s smartphone users. According to Statista, “In March 2020, around 99.3 percent of internet users in China used mobile phones to go online.”

Talk about a massive TAM…

There is a bit of a chicken and egg question in my mind. It seems to me that WeChat rode the wave of mobile phones and mobile internet in China, but I’d also be willing to wager that part of the reason that mobile internet (compared to desktop internet) is so popular in China is because of the sophistication and breadth of mobile apps, WeChat being the most relevant. There’s some positive reinforcing loop here.

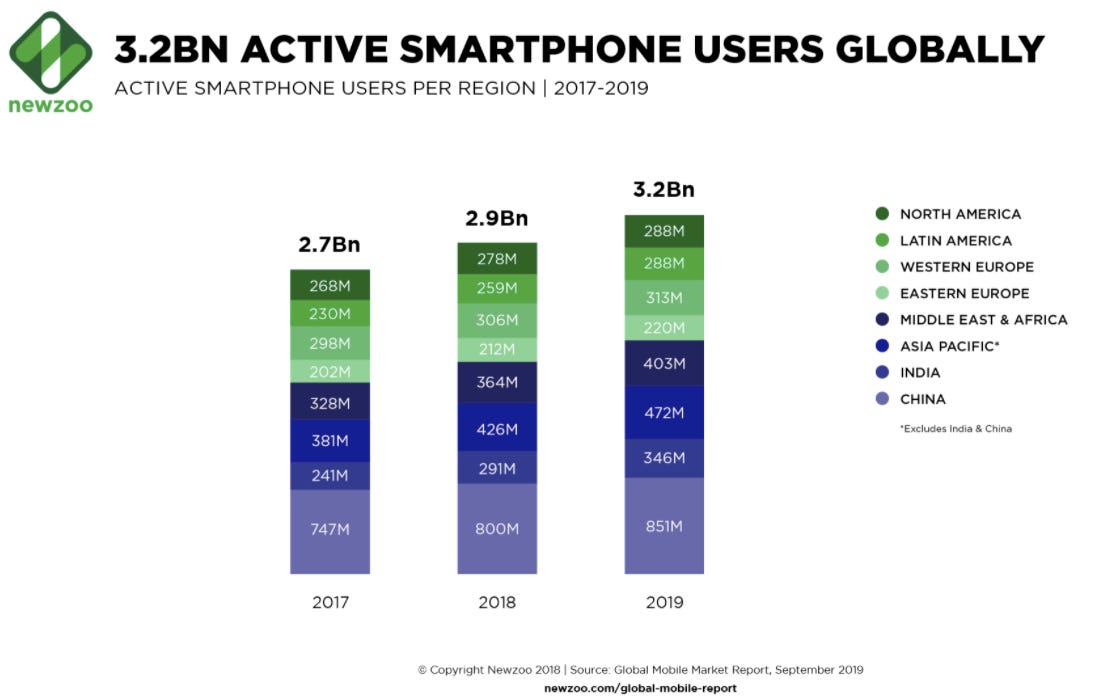

Besides riding the smartphone wave, WeChat, along with their duopoly competitor, Alipay, crested and then rode the payments wave.

(Source)

CB Insights points out that, “These growing use cases for mobile payments in the everyday lives of Chinese consumers catapulted China’s mobile payment volume from $1T in 2015 to $15.5T in 2017, with WeChat Pay and Alipay making up a whopping 92% of China’s total mobile payment volume as of Q3’17.”

In terms of WeChat Pay via QR codes, China also notably skipped the era of plastic cards.

China, meanwhile, was almost entirely cash-based one decade ago; that was the context for the rise of mobile payments, which represented their own gargantuan leap forward.

In my view, another chicken and egg situation. Did the fact that China ‘skipped’ the era of plastic cards allow WeChat Pay and Alipay to flourish or did China skip plastic cards because of WeChat Pay and Alipay?

To be a truly generalizable Super App, I believe you need to own your user’s wallet. This is part of a larger thesis on Super Apps that I’ll talk about in my next post.

In my last post, I proposed that WeChat began morphing into a true “Super App” at the point where it added official accounts (a pre-cursor for mini-programs) in May of 2013. In that same update (WeChat Version 5.0) WeChat added payments and the ability to buy stickers (one of their first monetization attempts).

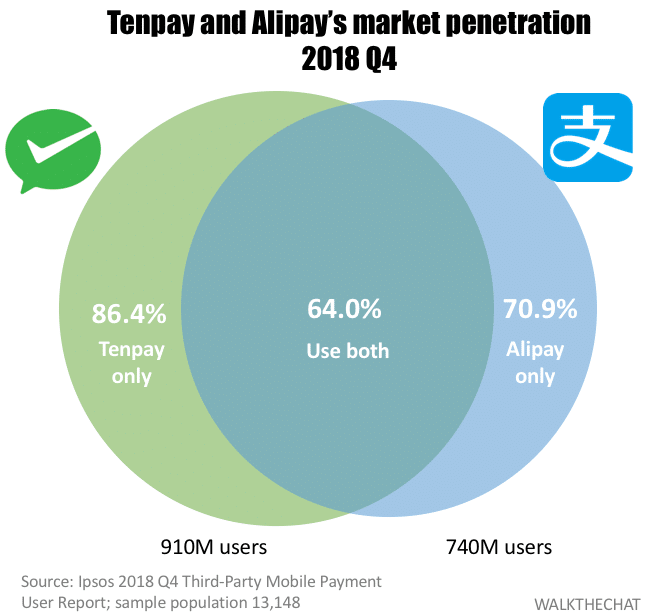

In Q4 2019, WeChat pay was doing more than 1 billion commercial transactions/day across its 800 million monthly active users and 50 million merchants. One way to think about WeChat mini-programs and their apps is that they’re storefronts built on top of a payment app, rather than a payment experience build into a website.

It’s actually a bit fuzzy where Tencent makes money on WeChat Pay. They don’t break out payments from “FinTech” and “business services” in their financial statements, but I am going to imagine they have a set up like Apple Wallet where they take a small fee on transactions (e.g., 0.15%) that otherwise would have gone to the banks/card issuers.

Six years later, in 2019, FinTech offerings drove $11.9 billion (22% of) Tencent’s total revenue.

WalkTheChat estimates what the WeChat Pay growth looks like over time:

(Source)

Besides the QR code payments that WeChat is well known for, they also offer FinTech products that include wealth management, consumer lending, insurance, and remittances, among many others.

To illustrate how big the Chinese FinTech market is, look no further than WeChat Pay’s most direct competitor, AliPay by Ant Financial (Alibaba). AliPay launched the Tianhong Yu’e Bao Money Market Fund (which basically amounted to a high-yield checking account) for users in 2013 and by 2017, it was the largest money market fund in the world, surpassing offerings from JP Morgan, Fidelity, and Vanguard. By March 2019, the Tianhong Yu’e Bao fund (which translates to “leftover treasure”) had about 588 million clients, 1/3 of the Chinese population.

In the fall of 2018, Tencent and WeChat launched their own similar product, LingQianTong (or “Mini Fund”). As of November 2019, it looks like WeChat’s product was managing about $112 billion and has been competing against AliPay’s product by offering higher interest rates. (A win for the consumers!)

One of the biggest contributions that WeChat Pay (and AliPay – but this issue isn’t about them!) has made has been bringing an entire country online to digital payments. China is the country with the highest rate of digital payments and its thanks to these two companies.

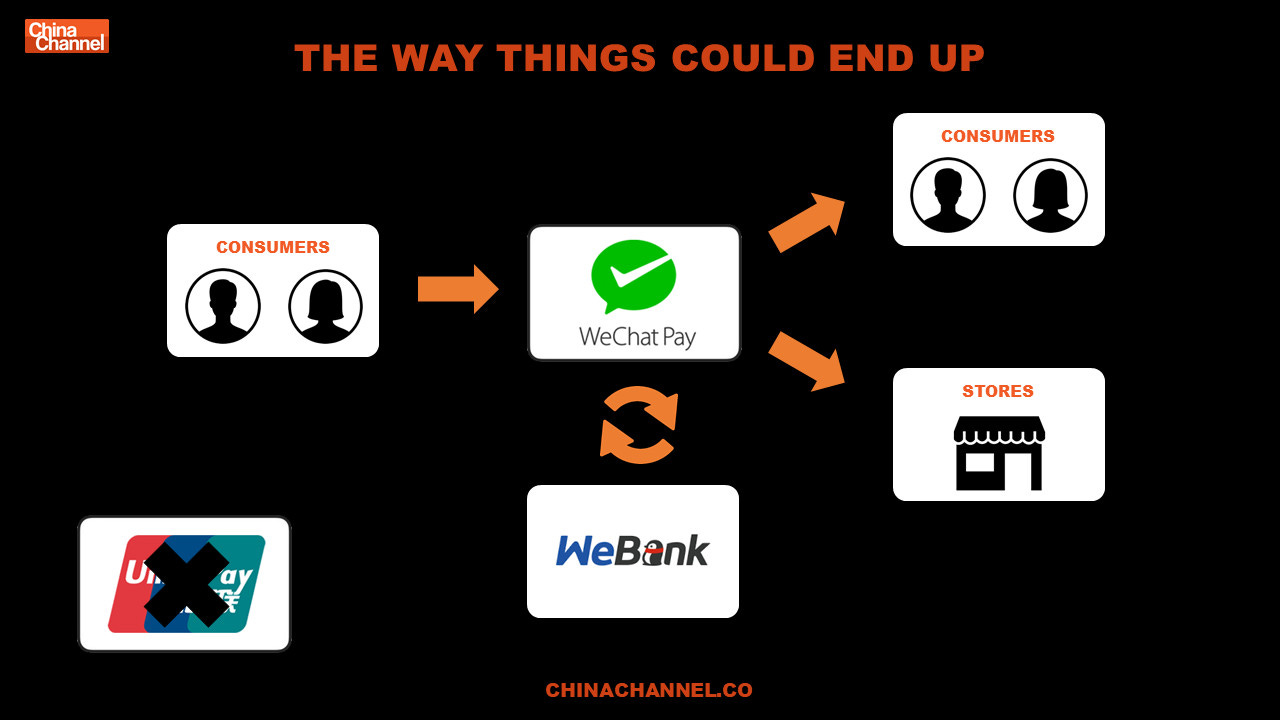

WeChat Pay also has a deep integration with “WeBank”, one of China’s first ‘neobanks’. WeBank could be the topic of another issue, but TL/DR is that WeBank is a Chinese neobank whose core revenue driver is acting as a broker connecting banks (lenders) with consumers and small businesses (borrowers) and taking a fee in the middle. WeBank’s largest shareholder is Tencent (~30%) and I believe the only reason Tencent doesn’t own more is due to some regulation around ownership levels of banks.

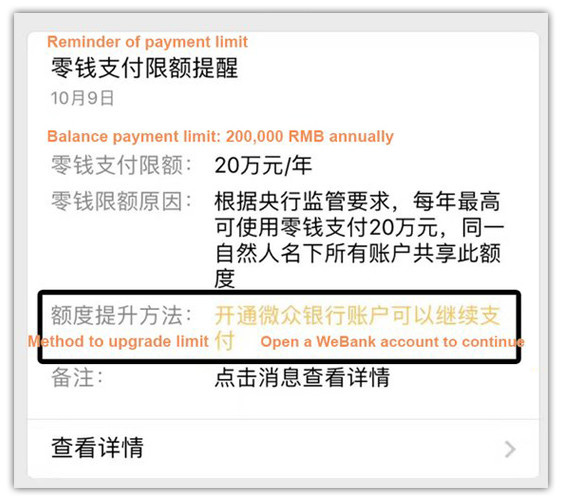

Like most countries, China has restrictions on banking licenses and consumer deposits. WeChat Pay (which is not a bank) has limits about how much you are able to transact annually (I believe ~30,000 USD), but once you hit that limit, WeChat recommends you to set-up an account with WeBank.

(Source)

As Matthew Brennan further points out, in China, the way WeChat Pay initially worked was that the user connected their bank account/bank card (UnionPay) with WeChat Pay and then made transactions.

In the new flow with WeBank, everything stays within the Tencent ecosystem and the bank account is no longer Union Bank, but rather WeBank! Perhaps the western comparison would be, instead of Apple partnering with Goldman Sachs to offer Apple Card, imagine if they were the largest shareholder in a neobank that they routed users to set up deposit accounts at.

(Source)

Many readers will be familiar with the very high customer acquisition costs for fintech companies. Well, imagine if you could launch your ‘neobank’ as an integration with your country’s most used application. That’s the WeBank secret sauce.

“Users can just login and register an account via the WeBank app,and create a new account card within 2 minutes. Moreover, this digital bank card is as safe as traditional bank cards, consisting of the basic functions including bank transfer, money deposit, consumption.

Tencent has totally integrated this digital bank card with WeChat, which is commonly used by 963 million monthly active users. The money in users’ WeChat accounts, and even other banks deposits, can be transferred to the WeBank’s account, and enjoy more than 4% annual interest rate.”

In part one, I shared the crystal-ball like quote from Pony Ma:

Before starting TalkBox, Heatherm Huang recalls seeing Pony Ma speak at a conference. Pony Ma shared that even though he had built China’s most successful messaging app (QQ), he was paranoid that his empire could still be destroyed. He hoped that if something was going to kill QQ that it be built by Tencent.

I’ve heard versions of that sentiment ascribed to Mark Zuckerberg, as well. “If something is going to beat our product, I want it to be built here.”

I’m reading the book No Filter about the history of Instagram right now and it’s clear that Mark Zuckerberg doesn’t actually mean that quote when he says it. He was very aware that Instagram was taking screentime away from Facebook and he did not like that.

Pony Ma of Tencent, on the other hand, showed that he meant this quote when he began taking resources away from Tencent’s very successful desktop messaging app QQ and investing all of Tencent’s vast resources behind WeChat.

WeChat basically failed at WINNING international markets with the same kind of ubiquity they have in China. Even in neighboring countries throughout Southeast Asia or in India where WeChat made a concentrated push, Facebook, WhatsApp, and apps local to each of those individual country rule.

BUT WeChat has a few other things going for it.

If you want to interact with China, you need WeChat. Celebrities have fan pages, foreign businesses use mini-pages, and foreigners wanting to do business with the Chinese are in a better place if they use WeChat. For a lot of Western countries (e.g., USA, Australia) politicians do not like their citizens on WeChat (because of censorship and data privacy concerns), but it’s the fastest way to work and network with China.

Tourist hubs like Las Vegas and New York have also embraced WeChat Pay because… ¥¥¥ ($$$). In just the first half of 2019, Chinese overseas tourist spending was $128 billion.

As early as 2016, WeChat allowed users to convert their RMB into currencies including USD, GBP, HKD, EUR, etc. to be able to spend at foreign merchants.

(Source)

To give some more perspective into WeChat’s global influence, let’s take a look at their relationship with Apple. In many ways, WeChat is the operating system of the phone in China. On Android, Apple, or Huawei’s new OS, WeChat is the same app with the same functionality.

Flashback to 2017 when tipping was taking off within WeChat. Tencent was not taking any service fees on tips and Apple made them disable their tipping function because Apple considered the tips to be in-app purchases (i.e., Apple needed their 30% vig). About 7 months later, Apple reversed their ruling (or WeChat made a change) that allowed for tips to resume on iOS.

Contrary to what I said two paragraphs above, for 7 months where tipping was disabled within WeChat on iOS, WeChat on iOS was actually inferior to other operating systems.

It’s hard to think of a western comparison but imagine your favorite/most used/most important mobile app did not work well on your phone. Say you had an iPhone and your WhatsApp, Twitter, or Email client was a really bad experience on your phone and that problem was unique to Apple iOS. Would you consider switching to a different operating system? Maybe.

As Allen Zhang said in a speech, even companies like Apple didn’t fully grasp WeChat and China:

“In the past, companies like Apple might have had a difficult time understanding China-specific features,” Mr. Zhang said, according to a transcript of his remarks provided by Tencent. “We now all share a mutual understanding and we’ll soon bring back the “tip” function.”

Something about that last sentence, “We now all share a mutual understanding” seems so subtly powerful and chilling to me. WeChat is making sure that others share an understanding with them.

In many ways, mini-programs are a threat to the Apple iOS. Ben Thompson has written extensively and informed my thinking on this topic. Apple only has a 50% iPhone retention rate in China, whereas Apple enjoys ~80% retention for iPhones in the rest of the world. iPhones are “hardware differentiated by software” and in China, the Apple OS software matters a lot less than in the rest of the world.

Let’s look at it on a feature-by-feature level.

What are the iPhone’s biggest lock-ins for users?

Here are some statistics from The Information and Sensor Tower showing app growth decline in China:

At the same time, the number of iOS apps downloaded in China in 2019 has fallen 12% from a peak of 9.3 billion in 2017, according to Sensor Tower. That compares with an increase of 22% to 7.1 billion apps downloaded in the U.S. over the same period. And developers are making fewer new apps for iPhone users in China. The number of iOS apps available in China as of February was down 20% from a peak of 1.84 million in 2018, Chinese government data shows. Meanwhile, App Store revenue growth in China has slowed to 11% in 2019 from triple-digit growth rates in 2015 and 2016, according to analytics firm App Annie.

I remember the first time I ever saw the WeChat app was in college. The girl next to me had the desktop app up and it was the ugliest Mac App I had ever seen. But to be frank, I don’t think Tencent cares that much about their desktop experience. In fact, WeChat did not launch a Mac desktop app until 2014 and didn’t launch its Windows app until 2015.

WeChat, unlike many Western apps I use, has a notably worse desktop experience than mobile experience because the app is meant for mobile consumption. The desktop version doesn’t include mini-programs, moments, payments, or any of the other features that make WeChat so powerful. The desktop app is simply, a messaging client.

While writing part one. I changed my view on how ‘innovative’ WeChat actually is.

I was pretty surprised writing part one how many of their features they copied from other companies, their own prior products, or from Alipay. For example:

And this leads to my next observation…

Tencent does a lot of things really well. At the top of that list is investing in other companies, especially those that are core to the WeChat ecosystem.

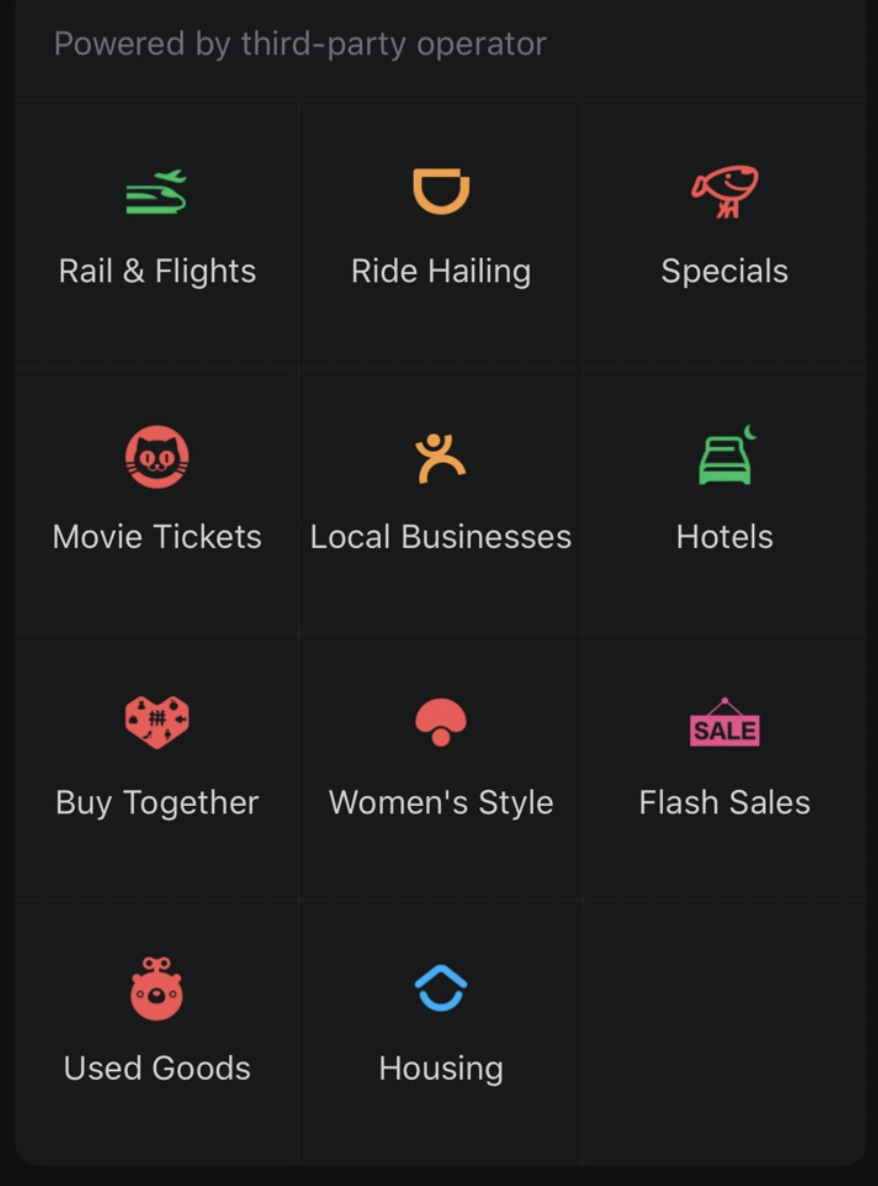

Here are some of the third-party apps prominently featured on WeChat’s “WeChat Pay” tab

Can you guess what’s in common about all of the companies powering these services? In most cases, Tencent is one of the company’s largest shareholders.

From Pinduoduo’s IPO prospectus, their relationship with Tencent is listed in their risk factors:

Tencent provides services to us in connection with various aspects of our operations. If such services become limited, restricted, curtailed or less effective or more expensive in any way or become unavailable to us for any reason, our business may be materially and adversely affected.

From Mogu’s IPO prospectus:

We collaborate with Tencent, one of our principal shareholders, on various aspects of our business, including the entryways on its platform serving as one of the major access points to our platform, as well as services such as payment processing, marketing and cloud technology. If services provided by Tencent to us become limited, compromised, restricted, curtailed or less effective or become more expensive or unavailable to us for any reason, our business may be materially and adversely affected. Failure to maintain our relationship with Tencent could materially and adversely affect our business and results of operations. In addition, we may experience a decline in user traffic if Tencent’s platform becomes less popular, which may have a material and adverse impact on our results of operations and financial conditions.

Wow!

Tencent/WeChat has two things going for it on the point of distribution.

WeChat is built on the shoulders (and graves) of many other companies and products.

On that note, it’s tough to imagine WeChat succeeding without Tencent. 3 parts to that argument

(Source)

What is WeChat without Allen Zhang?

When Allen was promoted to VP at Tencent. Tencent’s CEO said of Allen, “He is very spiritual in terms of products.”

Allen has an incredibly strong love of ‘product’, with a former colleague saying,

“In essence, Zhang Xiaolong [Allen Zhang] believes in the product itself, and marketing is second. This can be concluded from his attitude towards marketing: he will tell the marketing staff very directly that only a good product is true. Others are just icing on the cake.”

After the acquisition of Zhang’s first company, Foxmail, Zhang was asked about commercializing the software and his deep respect of product showed,

“The commercialization of free software is a step that must be considered. But it does not mean that the free software must be commercialized. There are many ways to develop it. Free software. We prefer to use foxmail’s brand and technical advantages to develop mail servers, etc. to make money. Sometimes a good free software, the value of which is to be considered in the long run, let’s say foxmail, we think that mail is an Internet application. The important piece, we will continue to develop it, just like why Microsoft invested so much in free IE. “

A similar sentiment came across when he was describing WeChat, saying that he thought of WeChat as a car, a tool used to get to a destination, but not the destination in itself. He wanted people to use WeChat to complete their tasks (communicate with others, share an update, get a taxi), but he didn’t want WeChat to be ‘the destination’.

Compared to an app like Facebook with relatively low ‘usefulness’, WeChat lists its second principle as usefulness.

(Source)

Reading about WeChat, it does seem that the design of the product has the same ‘key man risk’ that Apple had with Steve Jobs and then Jony Ive. Decision making at WeChat is very top-down, where yes, Allen encourages ideas from the team, but the final decision for everything related to the product rests on his shoulders. As is described in a good HBR article:

As Allen Zhang told us: “We encourage people who present their own way of thinking – I encourage them to speak out.” But at the same time, it is clear that he makes all the key decisions himself. As his colleagues explained, they submit new features to him for approval, and he decides on the icon, the nickname, and other key aspects of the user experience. Developers are keenly aware that the biggest challenge is how to ‘get past Allen’, and that many seemingly good features are vetoed by him.

WeChat is an intuition led (not KPI led) product. This stands in opposition to the Facebook metric-driven-growth philosophy. The western consumer apps that were historically most product-led were Snapchat and Instagram (less so now given FB acquisition and founders leaving).

In 2019, at the annual WeChat conference (like an Apple product launch event), Allen delivered a well-documented 4-hour speech. It gives great insight into his philosophy and was translated into English here. One line that sticks,

“Think for a second, how much time do you spend on WeChat every day? Do you spend more time with your closest family and friends, or with WeChat? If WeChat was a person, certainly it would be your best friend, that’s why you’re willing to spend so much time on it.”

(Source)

It’s interesting to think about what’s next for WeChat. Since WeChat has not been able to expand internationally and become the OS for another country in the way that it has for China, it’s inevitable that future monetization will not come from new users, but from adding more features for and getting more out of existing users.

As TechCrunch points out, even though WeChat’s monthly active user figures are staggering, WeChat’s year-over-year growth is now approaching single-digit percentages. This is to be expected as they’re probably at or near peak saturation in China and their international expansion has not gone well.

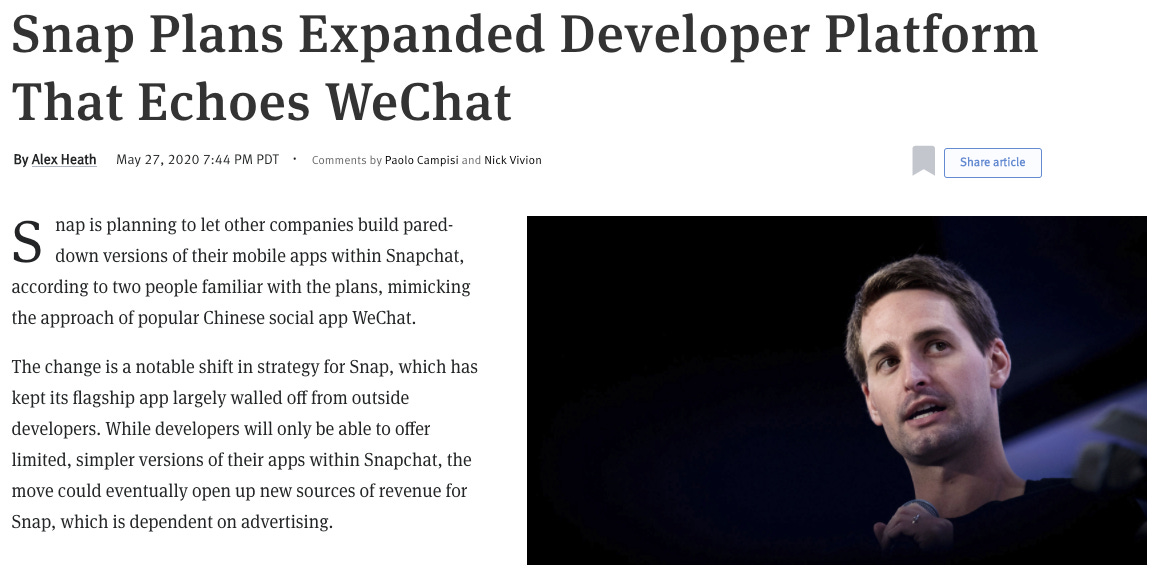

One thing is for sure, WeChat has influenced LOTS of other technology company founders and we will see companies attempting to copy its strategies for years to come. See photos below 🤣

(Source)

(Source)

(Source)

(Source)

My next issue will be a dissection of what exactly makes a Super App, the history of “Super Apps” (spoiler, it starts before WeChat), and what companies are poised to become Super Apps. My next issue might be 1 week late as (1) while I have a massive outline for my next post, I predict it’s going to be difficult to condense my ideas (2) I am taking a brief vacation and want to try and minimize screen time

First published on August 2, 2020